⚡️Breaking⚡️: Bird Canada to bail out Bird Global in reverse-takeover

The proposed deal would inject $32 million into the struggling e-scooter business

Bird Canada, an independently owned and run Canadian micromobility company (it’s confusing, I know), intends to merge with struggling e-scooter operator Bird Global Inc. in a transaction valued at $64 million, the companies announced today.

The deal has huge implications for Bird, whose recent woes include management tumult, a going concern warning, a penny stock price and possible delisting from the New York Stock Exchange, a recent admission that it systematically overstated revenues for 2.5 years, and a desperate campaign to chase down riders for unpaid pennies. This is a company in crisis, which told investors last month that it might not survive the next year without additional capital. Now Bird Canada is throwing the other Bird a lifeline. The price could be Bird Global’s entire way of doing business.

TOC (🔒 = paid subs content)

🇨🇦 Canada to the rescue 🇨🇦

The deal values Toronto-based Bird Canada at $32 million. The investors behind Bird Canada are injecting another $32 million into Bird Global BRDS 0.00%↑, the firm founded in 2017 by Travis VanderZanden, in the form of convertible notes. Bird Global will receive the first $4 million loan immediately, and the remainder at the transaction close, which is expected “as soon as possible,” per a press release.

As part of the deal, Bird Global will undergo a massive management shakeup. Bird Canada founder and CEO Stewart Lyons is being named president of the combined company. Michael Washinushi will replace Ben Lu as CFO. Three board members—Sequoia Capital’s Roelof Botha, Goldcrest Capital’s Daniel Friedland, and Craft Ventures partner/Elon pal David Sacks—have resigned, effective immediately. Their seats plus two vacancies will be filled by five reps from Bird Canada, and the board size fixed at nine, handing control to the Canadian team.

VanderZanden, Bird’s founder and former CEO, will remain on the board. Shane Torchiana, a four-year vet of Bird management who took over first as president and then CEO from VanderZanden in September, will continue to serve as CEO.

While Bird Global is framing this as a proposed merger, the reality of the money changing hands and the power structures being imposed is that it looks very much like a reverse takeover by Bird Canada.

John Bitove, chair of Bird Canada,1 said in a statement that the Canadian team’s “maniacal operating focus on profitability and customer service” will help turn Bird Global around. Torchiana said in the same press release, “We believe that this new funding, coupled with the operational rigor provided by the addition of Bird Canada, will contribute to Bird’s goal of becoming adjusted EBITDA profitable on a full year basis in 2023.”

🙋♀️ Ok wait, what is Bird Canada? 🙋

Yes, let’s clear that up. Bird Canada is an independently owned and operated micromobility provider. It was founded in 2019 by Stewart Lyons and a group of investors to bring e-scooters to Canadian cities. Bird Canada owns its scooters, e-bikes, and operating permits, and licenses the Bird name and software from Bird Global. It operates in 10 Canadian cities including Calgary, Edmonton, and Ottawa. Bird Canada has “consistently delivered best-in-class unit economics since its launch and delivered positive full year EBITDA in recent years,” the companies said in their press release.

Bird Canada most recently completed an early-stage venture round in August 2021, according to data from PitchBook, and did one seed round prior to that. Its investors include Relay Ventures, Obelysk, Alate Partners, and MacKinnon, Bennett & Co. On its ‘about’ page, Bird Canada describes itself as “proudly Canadian with an all-Canadian management team and backed by Canadian investors” which is honestly the most Canadian thing I’ve ever heard except maybe The Hockey Song.

The obviously notable point here should be that Bird Canada says it has been full-year EBITDA profitable. This despite the fact that:

Bird Global has very much not accomplished that

Canada is cold and not necessarily the first place you would imagine a shared scooter business being successful much less profitable

Bird Canada is a private company so we have yet to see a breakdown of its operating results. That said, the fact that the Canadian unit claims to have found a path to EBITDA profitability suggests it has a very different way of doing things from Bird Global. And that all-Canadian team is betting it can turn around the global company’s fortunes by imposing similar operational rigor in all markets.

🔒 A brief history of Bird woes 🔒

In case you haven’t been following Oversharing for the past few months (I forgive you, you’re here now), it’s been a no good, very bad year for Bird Global.

Over the summer, Bird disclosed that despite investing several years and a lot of capital into developing fancier and more rugged scooters, not enough people were actually riding them. The company didn’t put it exactly like that, but it did report that its deployed fleet averaged just 1.5 rides per vehicle per day in the three months ended June 30.

This is a shockingly low utilization rate. For example, if you assume that the typical scooter ride lasts somewhere between 15 and 20 minutes, that means each Bird scooter was being used on average for around 30 minutes a day. The micromobility industry rightfully likes to talk about getting people out of cars, which are bad for the planet and spend most of their time idle and taking up space, but Bird has hardly made a case that its e-scooters are being used any more regularly.

Things aren’t going any better for Bird on Wall Street. After going public via SPAC in November 2021 (not to mention raising $1.1 billion from private investors at a $2.8 billion valuation in its startup days), Bird tumbled to penny stock status in May and was warned in June that it could be delisted from the NYSE. Bird has wiped out the holdings of pretty much all private Bird investors. Also in June, Bird laid off nearly a quarter of its staff. The stock price has continued to decline and is currently hovering around $0.18 per share, which is significantly less than even the earliest Bird investors paid (the seed was done at $0.41 per share).

Cue the first management shakeup. In September, Bird elevated Torchiana to CEO, replacing VanderZanden, who had already handed over his president title. It brought in Ben Lu, an outside recruit, to replace Yibo Ling as CFO, while board member Justin Kan resigned in conjunction with the CEO change. Other changes at the top included head of comms Rebecca Hahn leaving for Twitter in July (she clearly has an affinity for troubled avian firms); general counsel Wendy Mantell departing in April; SVP of revenue Tom O’Brien switching to an advisory role in August; and chief vehicle officer Scott Rushforth stepping back to an advisory role from September.

In further signs of the times, VanderZanden put his Miami mansion on the market. (Actually, it looks like he’s accepted an offer! If it sells for anywhere near the $37.5 million asking price, that will be a pretty good deal by VanderZanden: a big markup from the $21.8 million he paid and a lot more than Bird Global is currently worth.) The Los Angeles mansion that VanderZanden purchased from The Daily Show host Trevor Noah in 2020 was also on the market as of last month, at a reduced price of $19.9 million.

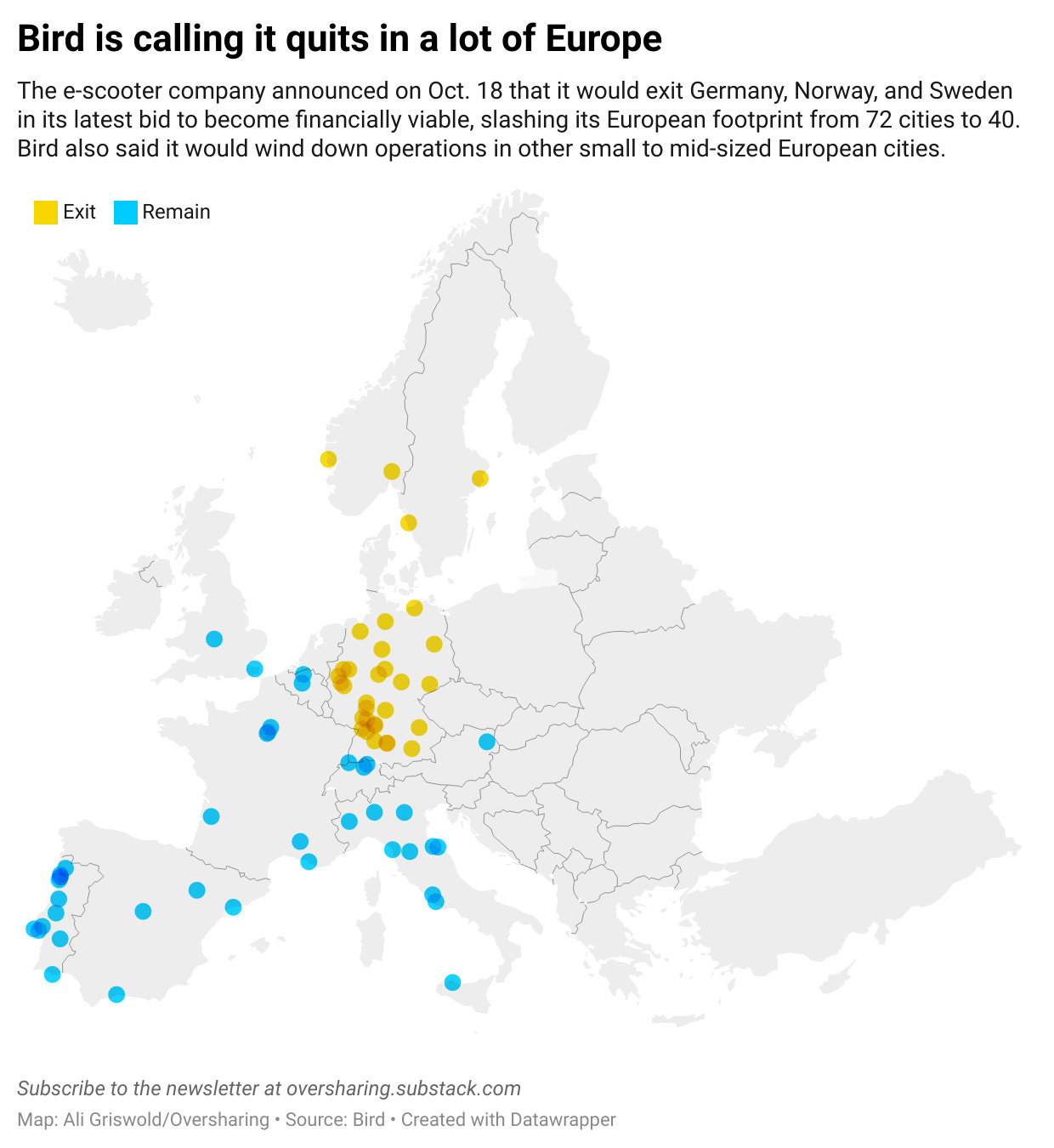

So: layoffs ✅, management overhaul ✅. Founder selling off major assets ✅. Next up in distressed company bingo, Bird announced it would exit nearly half of its European markets—32 of 72 cities—in a bid to “build an economically viable business.” Bird is widely considered in the industry to have failed to win important European tenders through a combination of political and operational ineptitude, locking it out of some of the biggest and most lucrative European markets.

Which brings us to the most recent Bird screw-up. Last month, at the same time as it reported Q3 results, Bird issued a going concern warning and told investors that it had systematically overstated revenues for 2.5 years, such that its financial statements for that period “should no longer be relied upon.” In a truly astounding error, Bird admitted that it had been recording as revenue Bird wallet payments for rides made by customers who didn’t actually have enough funds in their accounts. Bird Global is now busy chasing customers down for amounts like $0.70 from four years ago (truly, lol) with what has to be one of the worst email campaigns of all time.

And look: if there were ever a sign that a company was desperate for cash, it’s emailing customers who haven’t used your service in years demanding they pay you an outstanding balance of less than $1. I could give you more numbers from Bird’s balance sheet and financial statements, but if you ask me that email says everything you need to know. This is a company in dire straights that needs cash however it can get it.

🔒 Can Bird Canada… flip the Bird? 🔒

The big question is whether the proudly Canadian Bird Canada team is right to believe that it can turn Bird Global around and get it to profitability. The merger release says the goal is for Bird to reach adjusted EBITDA profitability on a full year basis in 2023, and presumably for straightforward EBITDA profitability to follow after that. The immediate infusion of $4 million in cash should give Bird Global some breathing room, with more to follow assuming the transaction is completed.

While it’s too soon to say how the deal will play out for Bird beyond the announced changes to management and the board, here are some things I’d expect to see from a Bird Canada team with a “maniacal operating focus on profitability”:

Smarter device deployment. As I said above, Bird Global is averaging 1.5 rides per scooter per day which, frankly, is terrible. Utilization is one of the most important operating metrics in micromobility: the more rides you can get out of each scooter, the better you are generally going to do. Bird Global execs have recently started talking about re-focusing on vehicle deployment to improve utilization, for instance by placing scooters at strategic hubs and intersections where people are more likely to come across and ride them. This might seem like an obvious step for a micromobility operator, but as Bird Global has yet to take it, it’s low-hanging fruit for a new management team.

Take a close look at spending. Bird Canada will presumably want to rein in costs at Bird Global. That could mean cutting jobs, exiting additional markets, and taking a close look at areas where Bird is spending a lot, for instance general and administrative, which was Bird’s largest operating expense in the latest quarter.

Switch to swappable batteries. Bird Global has gone against most of the industry and opted for larger built-in batteries in its e-scooters rather than smaller ones that can be swapped out by ops teams. This was understandable in the early days of scooter design and development, but the industry consensus these days is that swappable batteries are better and operationally more efficient.

Invest in regulatory relationships. With cities increasingly favoring a limited number of micromobility operators chosen through tenders and RFPs over the free-for-alls that defined the early days of e-scooters, building good relationships with policymakers and local officials is more important than ever. Bird is thought to have lost out on important European markets because it fumbled these relationships. You could also argue that the company has suffered from too much early Uber DNA. VanderZanden, who worked at both Uber and Lyft before founding Bird, infamously dumped a bunch of scooters in Bird’s first market of Santa Monica without asking permission, then notified the mayor of the “exciting new mobility strategy” in a LinkedIn message, which is not the way to make political friends last time I checked.

Again, many of these seem like obvious steps. Utilization and any trimmable spending are clear targets. Swappable batteries seem like a good product move, though it could take a while to convert Bird Global’s entire fleet. And anyone who has followed ride-hail should know that policy and regulations are hugely important to the operational success of a transport provider (even if you believe that Uber is just a ‘tech platform connecting people who want to get a ride with people who want to give a ride’). The point is that obvious or not, Bird has yet to implement these measures. It has left the low-hanging fruit on the branch, and the weight of it is dragging down the entire tree. If nothing else, that gives Bird Canada a good place to start.

Update, Dec. 20. An earlier version of this post mistakenly conflated John Bitove with JJ Bitove. John Bitove is co-founder and chair of Bird Canada. JJ Bitove, his son, is co-founder and CFO of Bird Canada.

I was reading along calmly and peacefully until I had a coffee-spray-across-the-desk moment when I got to "Can Bird Canada... flip the Bird?" Nice one! 😁