Angry Bird

Desperate for funds, the e-scooter firm is chasing riders for pennies

Greetings from a snowy London! A few housekeeping notes before we dive in:

🚲 I’m moderating a webinar on “micromobility’s path to profit,” a favorite Oversharing topic, Thursday Dec. 15 at 11am Pacific/2pm Eastern/7pm GMT. Join if you like! Registration details here.

📣 Micromobility Industries, which put together the above panel, is organizing a “Rider’s Choice Awards” for the first time. There are lots of categories with elimination-style voting open through Dec. 15 for the semi-finals and Jan. 9 for the finals. I’m flattered to be in the running for “Top Journalist” with this newsletter. If you’d like to vote in that or any other category (“Best Regulation & Policy” sounds fun to me) you can do that here.

🎁 All Oversharing subscriptions are 25% off through Dec. 31 at this link, a perfect gift for the micromobility and/or policy nerd in your life.

🎄 Lastly, a heads up that publishing will be intermittent between Christmas and New Year’s. Enjoy the holidays and we’ll hit the ground running again in 2023.

November was a bad month for Bird Global Inc.

Hours before reporting third-quarter results, the e-scooter firm disclosed that it had inflated revenue for the past 2.5 years and as such its financial statements for that period “should no longer be relied upon.” If that weren’t bad enough, the quarterly results, when they came, packed a second punch: warning that Bird didn’t have enough cash to make it through the next 12 months and that without additional investment there was “substantial doubt about the Company’s ability to continue as a going concern.”

Bird blamed the revenue overstatements on a problem with how it tallied payments from customers using prepaid balances in their digital Bird wallets. Bird offers several ways to pay for its micromobility services, one of which, “Bird Cash,” involves loading credit to a Bird account and using it to pay for rides. As we talked about before, this is not dissimilar to how many metro systems sell metrocards that riders load with credit to pay for transport services. And as anyone who’s ever used a metrocard knows, sometimes you run out of money. The question is what happens then. Some transit systems let passengers carry a small negative balance before they’re forced to top up; others block them from entering until their balance is replenished.

This is where Bird screwed up. The company let customers whose wallets were short on funds take rides on its bikes and scooters. That in and of itself isn’t a problem, it’s what Bird did next: record the full price of those rides as revenue even when riders didn’t actually have enough credit to pay, and in situations where, as the company later admitted, “collectability was not probable.”

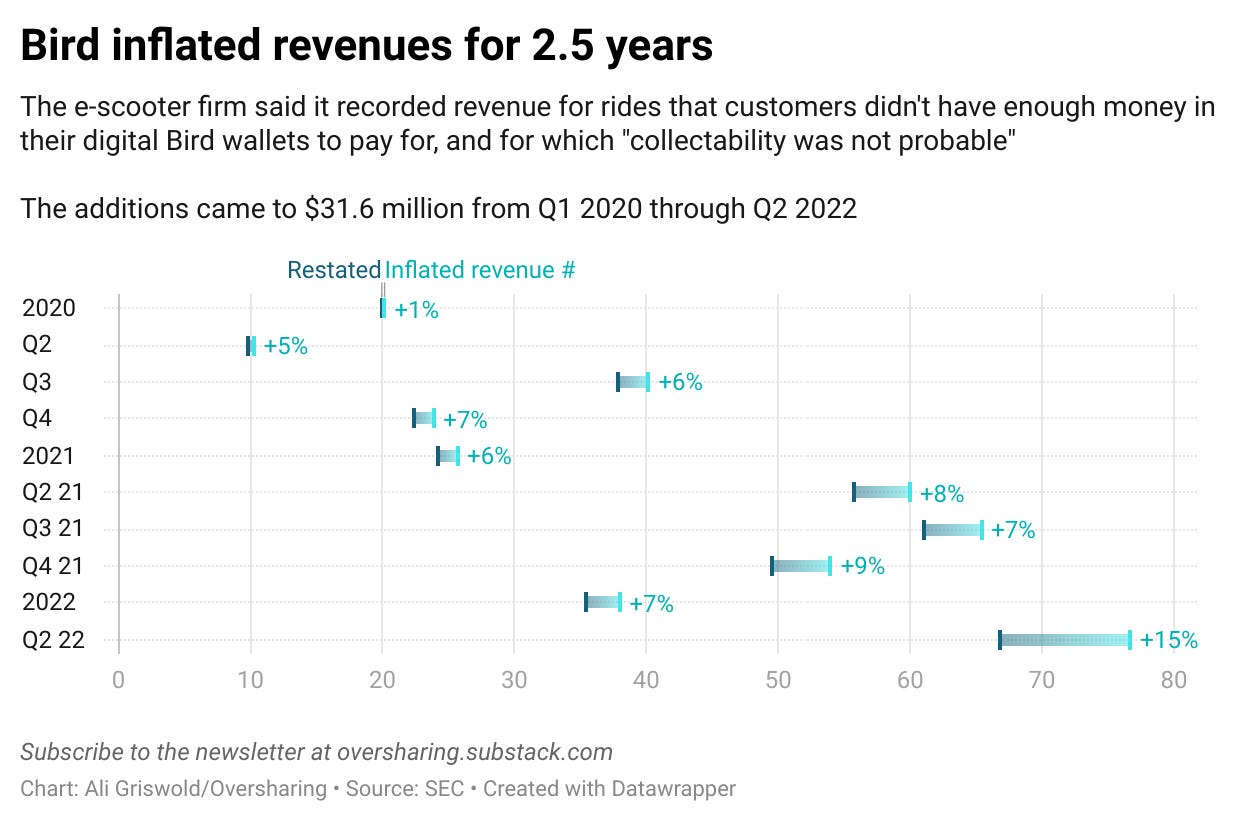

From the first quarter of 2020 through the second quarter of this year, those overstatements totaled $31.6 million, roughly equivalent to 10% of the restated revenue that Bird has now published for that period. In other words, this wasn’t a rounding error, it was a material difference in the revenue numbers that Bird was reporting. The inflated quarterly revenue figures were typically 6-8% more than the new restated figures, and a full 15% greater in Q2 2022. Unsurprisingly, there are now several shareholder lawsuits pending against Bird over its “false and materially misleading statements” of scooter revenue, as one complaint alleges.

On the flip side of the wallet issue, Bird CFO Ben Lu said last month that the company expects a one-time bump in its revenue statement next quarter from calculating the value of Bird balances that are unlikely to ever be spent, known in accounting terms as “breakage revenue.” It’s the same concept that companies apply to unspent balances on gift cards that, after a certain period of time, are unlikely to ever be redeemed and can thus be recorded as revenue. Barnes & Noble has surely recorded at least $50 in breakage revenue from me over years of gift cards that were either lost or left to languish with a couple dollars still on them.

Anyway, back to Bird. The company is now caught between that proverbial rock and hard place. The stock BRDS 0.00%↑ has continued its stubborn descent, closing yesterday at $0.20 per share, which these days won’t even buy you a banana at Walmart. As of Sept. 30, Bird had $38.5 million in unrestricted cash and cash equivalents, which it deemed insufficient to meet its costs for the next 12 months. One way or another, Bird needs more cash, and it could hardly come at a worse time. High interest rates plus widespread economic and geopolitical upheaval have conspired to make it a bad time to raise money in general, much less to seek rescue financing.

While Bird pursues a funding deal, it’s also embraced that old adage, “a penny saved is a penny earned.” By this I mean that Bird has literally started hounding riders for pennies in what seems like a last-ditch effort to recoup some of those unpaid balances that it incorrectly recorded as revenue for 2.5 years.

Customers aren’t stupid. Mzisawesome clearly gets it (“Y’all must be strapped for cash right now”) and I’m inclined also to agree with Kramerman96 that chasing people for pennies years later is an extremely petty business decision. But companies (and startups!) in trouble will do desperate things. Also: I don’t know who wrote this email, but honestly it is a masterclass in composing a fuck you. For starters, it doesn’t even attempt to explain to customers why Bird is suddenly coming after them for small of money, in some cases years later. It says Bird has “run into an issue trying to charge your payment method,” which implicitly shifts the blame to the customer or their payment method and away from Bird. It issues a low-key threat: pay us or you can’t use our service. It finishes, in the best line of the whole thing, “Love, Bird.”

And hey, look, if Bird can claw back a bit of that $31.6 million that will certainly give it a boost, and may end up being worth it. The question will be how many people it burns in the process. Something tells me that a lot of customers who got that email will be turned off from using a Bird service again, even if they do level off their negative balances. But there you have it, Bird is angry, it is done playing nice. It needs more money, however it can get it. Otherwise its balance will go negative, and then it won’t be starting any new rides, and it will owe a lot more than $0.78.

Love,

Oversharing