Tech sector layoffs come for DoorDash

"We were not as rigorous as we should have been in managing our team growth"

DoorDash has been on a rollercoaster since going public in December 2020. Or, at least, its stock price has.

In its first year on the public markets, DoorDash soared as high as $246 a share, thanks to a pandemic boom in demand for food and groceries delivered at home. In its second year, DoorDash erased those gains and then some. Shares have collapsed 77% from their December 2021 high, to around $57. DoorDash’s market cap stands at $22.2 billion, far less than the $71 billion valuation it debuted at, but still above any of its valuations in private funding rounds, which is more than many of its publicly traded peers in the gig economy can say.

Like those gig peers, DoorDash has yet to become reliably profitable. The company posted a one-off quarterly profit of $23 million in its IPO filing for Q2 2020, but has since failed to repeat that while its quarterly loss has now ballooned for five straight quarters. In the latest quarter, ended Sept. 30, DoorDash reported a net loss of $295 million on revenue of $1.7 billion. It did better when measured by its customized metrics with $420 million in contribution profit and $87 million in adjusted ebitda (honestly, why even have custom metrics if they don’t make you look good). Those results combined with a few other tidbits (U.S. market share up 14 percentage points; DashPass subscribers at an all-time high) were good enough for investors, who sent shares up 10% on earnings day.

The drag on the results was that net loss, which was even bigger than analysts expected, and nearly 3x the $101 million net loss from the same period a year ago. The spike in this quarter’s loss came from increased spending on costs and expenses:

$931 million in cost of revenue, +59% year over year

$418 million on sales and marketing, -6% y/y

$226 million on research and development, +97% y/y

$316 million in general and administrative, +69% y/y

$118 million in depreciation and amoritization, +188% y/y

All in all, total costs and expenses in this Q3 were up 46% from Q3 2021, thanks to big jumps in spending on everything except sales and marketing. Some of those categories are pretty straightforward, but others are less obvious, so here’s some definitions based on DoorDash’s investor filings:

Cost of revenue (ex. depreciation and amortization)

(1) “order management costs” such as payment processing charges; costs of cancelled orders; insurance expenses; costs from non-partner merchant orders; and costs from first-party product sales

(2) “platform costs” like onboarding merchants and delivery workers [Dashers]; support for customers, merchants, and Dashers; and tech platform infrastructure

(3) “personnel costs” such as salaries, bonuses, benefits, and stock-based compensation expenses for local ops, support, and other teams; allocated overhead for facilities (e.g. rent and utilities) and information technology costs among all departments

Sales and marketing

Advertising; spending on merchant, consumer, and Dasher acquisition, including referral credits and fees; brand marketing; compensation expenses for sales and marketing employees; and commissions expense; allocated overhead

Research and development

Compensation expenses related to data analytics and platform design/product development; software licensing fees; allocated overhead

General and administrative

Legal, tax, and regulatory expenses; compensation expenses related to administrative employees; chargebacks for fraudulent credit card transactions; professional services fees; transaction-related costs; restructuring charges; bad debt expense; allocated overhead

Depreciation and amortization

Depreciation on equipment for merchants; computer and software; office equipment; leasehold improvements; amortization on capitalized software and website development costs; acquired intangible assets

I’m telling you all of this because I think it helps to explain why yesterday DoorDash announced plans to lay off 1,250 people, or roughly 7% of its employees. “Most of our investments are paying off, and while we’ve always been disciplined in how we have managed our business and operational metrics, we were not as rigorous as we should have been in managing our team growth,” CEO Tony Xu said in a note to staff. “That’s on me. As a result, operating expenses grew quickly.”

Indeed, in the latest quarter, DoorDash attributed increased costs and expenses in several of those categories we just talked about—cost of revenue, R&D, and G&A, as well as increased costs in sales and marketing that offset other savings—to “growth in headcount.” In other words, to cut costs, DoorDash needed to cut people.

In retrospect, Xu seems to have hinted at layoffs on DoorDash’s Q3 investor call earlier this month when answering a question about investing for the long term. “So from where I sit, certainly, we’re taking that into account in terms of the cost of capital and making sure that we’re operating with discipline, making sure that as we’ve grown tremendously the company over the last couple of years that we’re as efficient as we were heading into the last couple of years,” he said. “And that takes a lot of discipline, but it also takes a lot of intentional focus to make sure that we’re not just investing in people, but we’re investing in the systems to allow us to see operating leverage into the future.”

Xu has always described DoorDash as a disciplined and capital efficient company, and that may be true, but it also conveniently forgets just how much money DoorDash raised from private investors to build its food delivery service. Through June 2020, DoorDash received $2.9 billion in private funding from investors including Sequoia Capital, Kleiner Perkins, Dragoneer, Temasek, and of course, SoftBank.

The steady stream of venture dollars to DoorDash was a sore point for established industry player Grubhub, which had a profitable business and a majority share of the U.S. food delivery market before DoorDash and other VC-funded startups came on the scene. Grubhub sold to European competitor Just Eat Takeaway in June 2020 and is now the target of a divestment campaign by JET activist investors. That’s not to say DoorDash didn’t run a smart business, but simply to point out that when you’re vying for marketplace dominance, it helps to have a couple billion dollars in your pocket.

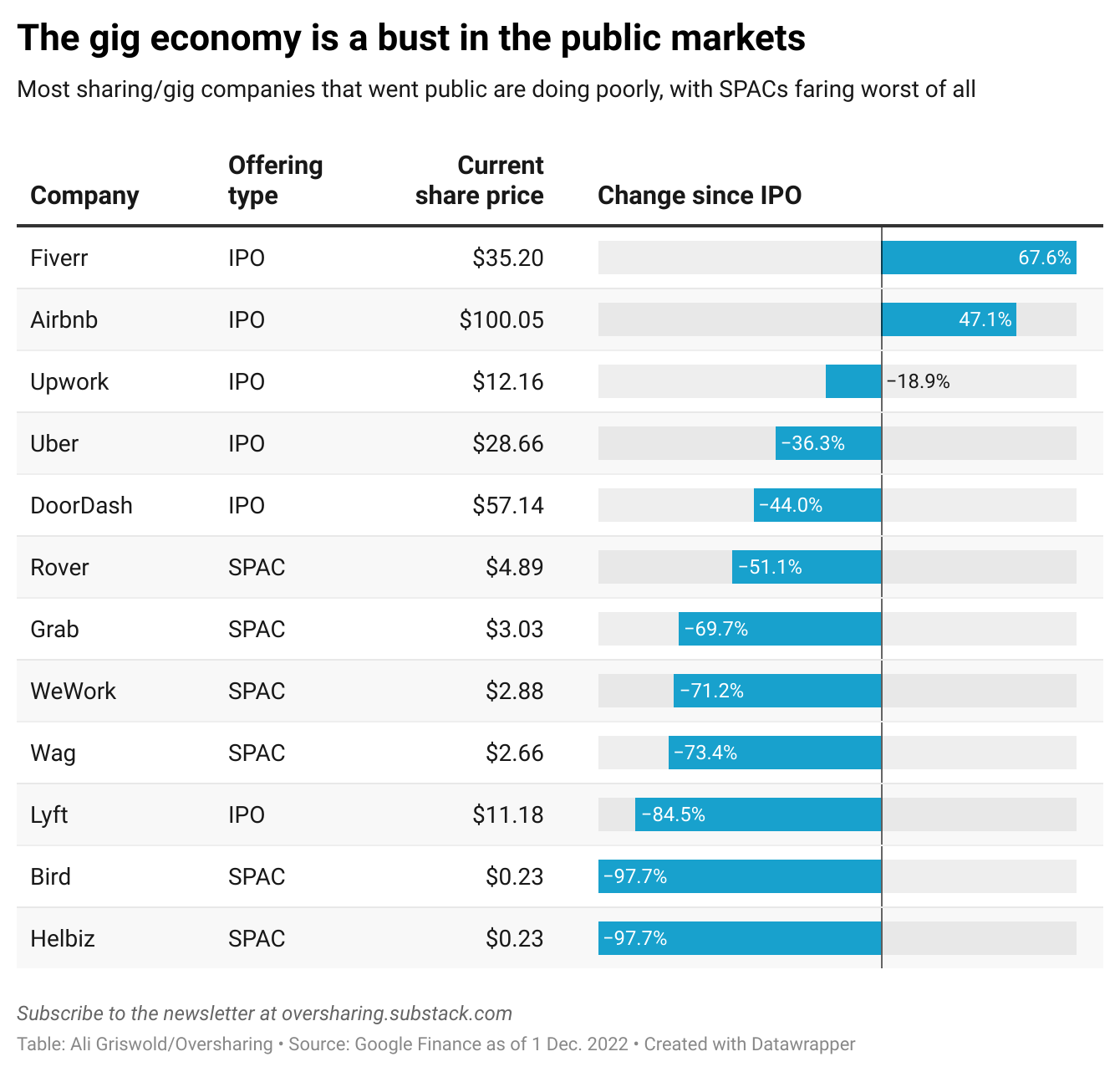

Zooming out, DoorDash isn’t doing the best of the gig companies to have gone public, but it’s certainly not doing the worst. The stock is down about 44% from its IPO price, which is a little worse than Uber and a little better than dog-walking startup Rover. As I’ve said before and will keep saying: the problem with venture-capital funding is that it allows companies to put scale before profits. That’s ok in the short term, but a lot of these gig and sharing companies have now had a decade to make the economics work, and are still struggling to figure it out. That’s when you have to start asking questions or, in DoorDash’s case, making some painful cuts.

In the sprit of the holiday season (or just for a welcome change), how about some articles on companies in the delivery and mobility sectors that are actually thriving in serving all their stakeholders well. They may not be gig companies, but maybe that’s the point.