Why Just Eat soured on Grubhub

North America has become a real headache for the European delivery giant

Hello and welcome to Oversharing, a newsletter about the proverbial sharing economy. If you’re returning from last time, thanks! If you’re new, nice to have you! (Over)share the love and tell your friends to sign up here.

Oversharing is now a subscriber-supported newsletter. Paid subscribers get three posts per week with the most in-depth analyses of the gig economy, mobility, and urban life; full access to the archive; and exclusive access to comments and community threads. Subscribe now for a special launch period rate of $7/month or $70/year.

Failed to deliver.

2020 was a year of frenzied food delivery mergers. Uber was in talks to acquire Grubhub but then ended up buying Postmates instead, leaving European delivery giant Just Eat Takeaway to nab Grubhub in a $7.3 billion all-stock deal. It was the second major deal that year for Dutch online food ordering platform Takeaway.com, which bought British competitor Just Eat for $7.8 billion in January.

It took until June 2021 for Just Eat to complete the Grubhub acquisition, at which point it thankfully did not also add ‘Grubhub’ to its name. As part of the deal closing, Grubhub promoted president and CFO Adam DeWitt to CEO and appointed co-founder and longtime CEO Matt Maloney to the Just Eat board to focus on North America. A few months later, Maloney stepped down.

Less than a year later, Just Eat is now looking to unload the American firm in a partial or full sale, it said in a trading update this week, citing “alignment with shareholders.” Activist investor Cat Rock Capital, which owned 6.5% of the company as of October, has pushed for Just Eat to sell Grubhub and refocus on its “enormous European same-day delivery opportunity.” Cat Rock has an entire website, justeatmustdeliver.com, devoted to its position, where you can read its 45-page presentation on the case for Just Eat selling Grubhub, complete with seven whole pages of “logical GRUB owners.” So many! Logical! GRUB! Owners!

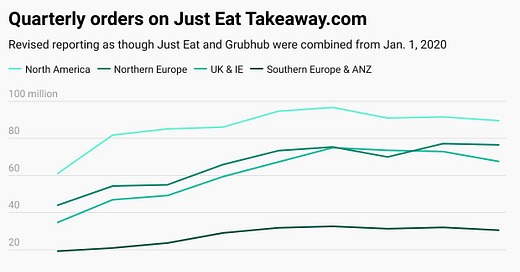

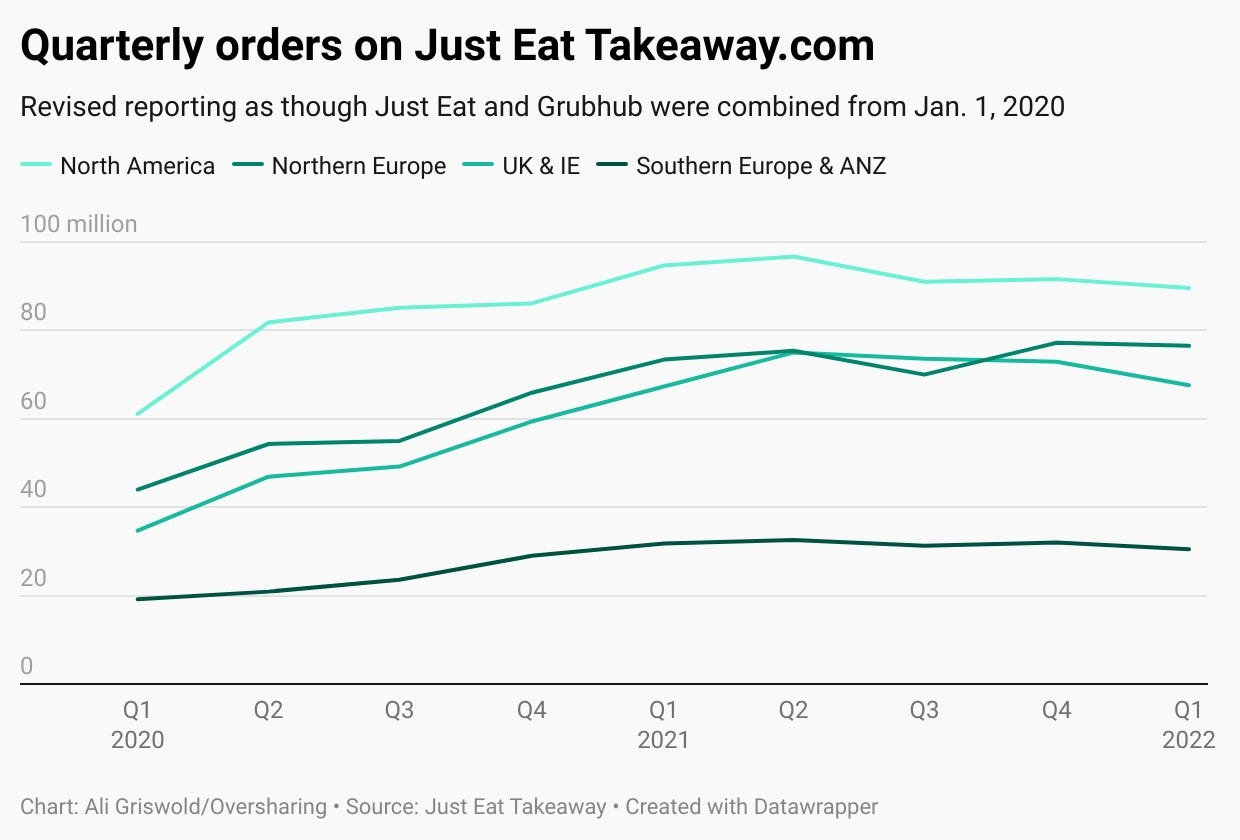

What went wrong with Just Eat and Grubhub? North America is Just Eat’s biggest market in terms of order numbers and also boasts the highest take rates (21-22%), but it is unprofitable, losing €28 million on an adjusted EBITDA basis in 2021. Orders in North America also appear to be slowing, falling 5.4% in the first quarter of 2022 from the same period last year. Grubhub had lost its leading position in U.S. online food ordering even before the Just Eat deal, and things have only gotten worse since then. According to third-party transaction data from YipitData, Grubhub’s market share fell to 11% in March compared to 21% two years earlier, while competitor DoorDash’s share grew to 57% from 44% in March 2020.

Compounding that you have the regulatory situation.

During the pandemic, cities in the U.S. and Canada capped the fees that food delivery apps like Grubhub could charge to restaurants, which were hit especially hard by covid-19 restrictions. Several major cities have now made these limits permanent. San Francisco was the first city in the U.S. to do so, with the Board of Supervisors voting unanimously to limit food delivery commissions to 15% in June 2021. New York City, Grubhub’s longtime stronghold, followed two months later, with the city council capping fees at 15% of food orders for delivery services and 5% for other services like marketing and lead generation. In its full year 2021 results, Just Eat noted these North American fee caps had a “significant €192 million impact on revenue.” The company joined competitors in suing San Francisco and New York City over the policies. On top of that, Grubhub is also among the targets of an antitrust lawsuit accusing delivery firms of driving up menu prices during the pandemic, which a U.S. judge ruled last month could proceed.

In short, Grubhub’s business is lackluster and North America has become something of a headache for Just Eat. By comparison, Northern Europe has the lowest take rates among Just Eat’s regional businesses, but was the only region to report a profit in adjusted terms in 2021 (€256 million). Order numbers in Northern Europe have grown steadily on a quarter-over-quarter basis, including in the latest quarter, even as they stalled or fell in other markets, probably due to widespread vaccination and loosened covid restrictions meaning people can finally dine out again.

You can see why Cat Rock is keen for Just Eat to refocus on Europe: the metrics are better and the regulatory environment, as of now, is friendlier. The ill-fated Just Eat-Grubhub deal is another chapter in the frankly sad saga of how Grubhub, a profitable company with a sound business model, was unseated by an unhealthy venture capital ecosystem that bet big on a handful of food delivery startups and gave them billions of dollars to lose. I mean, DoorDash still isn’t profitable! It lost $468 million in 2021, $461 million in 2020, and $667 million in 2019! DoorDash is now investing in ‘instant’ delivery, even though a DoorDash exec admitted at a conference last month that it may not be possible to offer instant delivery and be profitable. As I’ve said before, Grubhub was a rational player in an irrational market. Just Eat seems to have learned that the hard way, and now it’s ready to bow out.