Hello and welcome to Oversharing, a newsletter about the proverbial sharing economy. If you're returning from last week, thanks! If you're new—and there are lots of you—nice to have you! (Over)share the love and tell your friends to sign up here.

Lyft off.

Congratulations to Lyft for kicking off our 2019 IPO party! The company’s registration statement is here. It is very pink.

Unlike Uber, which has shared its financials with investors and select media for the last several years, Lyft has widely disclosed relatively little financial information until now. Delving into it gives us a better sense of how Lyft and Uber stack up.

Bookings (defined by Lyft as total value of rides and other revenue, such as shared scooter and bike fees, but not including tips, tolls, sales tax, and other parts of bookings that are passed straight from the customer to the driver or government)

Revenue (portion of bookings Lyft takes in service fees and commissions; roughly the share of sales left after paying out regular wages to drivers)

Net profit (spoiler, it’s a loss)

Meanwhile in risk factors, Lyft warned it has never made any money and can’t promise it ever will, a disclaimer popularized by companies like Twitter, Square, Etsy, Box, Dropbox, Snap, Blue Apron, Shopify, Twilio, Spotify, and of course the patron saint of all profitless companies, Amazon. As a writer on the internet, I guarantee you that any time you critique a company for being unprofitable, someone will pop up somewhere else on the internet to inform you that your analysis is sadly misinformed, and has missed that Amazon also was not profitable, and would you really bet against Amazon, because that seems awfully stupid. My counterpoint to this is that it seems statistically unlikely that every new unprofitable company will become the Amazon of its era, and in the ride-hail space in particular I would place my bets on Uber before Lyft, but sure, you never know, stranger things have happened.

Elsewhere in Lyft IPO coverage:

Meet the ‘OG’ Uber and Lyft drivers who could cash in on the IPOs (MarketWatch)

Mickey vs Masa: The battle between Uber and Lyft pits two Japanese billionaires against each other (CNBC)

What Lyft talks about as risk factors that other companies don’t (Quartz)

JPMorgan Nabs Lucrative Stabilization Role in Lyft IPO (Bloomberg)

It’s Lyft With a Y, and a Why (Bloomberg Opinion)

Scooters!

An updated version of last week’s Louisville scooter analysis is on Quartz. After consulting with resident Quartz data expert Dan Kopf, I limited the analysis to the 129 scooter IDs that first appeared in August 2018—the initial cohort of Birds, you could say, as Lime didn’t start operating in Louisville until November). Also, after Louisville chief data officer Michael Schnuerle said he wasn’t sure how scooter IDs were assigned, I asked Bird to share how it defined the ID number. Bird declined. With that in mind, here are the updated Louisville findings:

Average scooter lifespan was 28.8 days

Five of the 129 initial-cohort scooters disappeared the same day they went into service (a lifespan of “0” days)

The scooter with the longest lifespan made it 112 days, last appearing in the data on Nov. 29

Only seven of 129 scooters lasted more than 60 days

We also added some caveats, which I think are worth repeating here:

It’s possible the scooters Bird launched with in Louisville were already worn down from use elsewhere. It’s possible that after about a month Bird removed scooters from circulation in Louisville and put them in another city. It’s possible that if a scooter receives significant repairs, it’s put back into the market with a new ID number. It’s possible that our hero 112-day scooter is still out there somewhere! We don’t know, and the people who do aren’t sharing the information.

All that said, it’s also possible that the average scooter really was rendered useless after 28.8 days. As I said last week, the initial devices were clearly not designed for heavy shared use. Another factor we didn’t discuss last week is vandalism, which has plagued shared electric scooters across the US since they began rolling out. Where there are scooters, there are also people who will light them on fire, toss them into lakes and oceans, or hang them in trees, all surefire ways to shorten their lives. You can witness much of this on “birdgraveyard,” an Instagram account that documents scooter “deaths” and has nearly 80,000 followers. Scooter advocates argue these “bad actors” will eventually get bored, but as anyone who has walked around a city recently could attest, people never seem to tire of removing the front wheel from a bike.

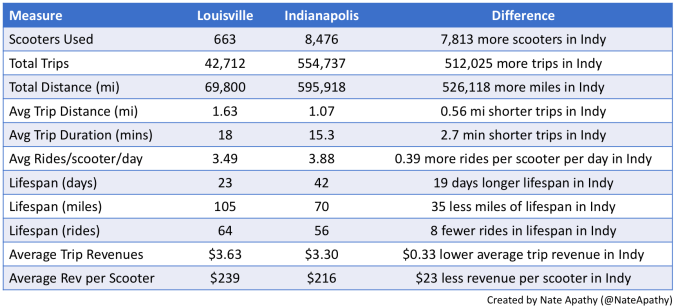

Elsewhere in scooternomics, Nate Apathy, a PhD student in health policy and management at Indiana University, ran the numbers on Bird and Lime in Indianapolis. The city approved rules for dockless vehicles in July 2018 after pulling hundreds of Bird and Lime scooters that launched without permission off the streets in June. Those rules included an upfront operating fee of $15,000 per company, plus a daily operating charge of $1 per device, with an initial allocation of 1,500 scooters each.

Apathy initially estimated the average scooter lifespan in Indianapolis at 42 days, 70 miles, and 56 rides. That was more days, fewer miles, and fewer rides than in Louisville. The average scooter in Indianapolis did slightly more rides per day than in Louisville, but with a slightly shorter trip duration, for less revenue per scooter overall. After we chatted he re-ran it for scooters with an “end” date before Dec. 1, 2018, and found the average lifespan dropped to 31 days. Apathy made a table nicely summarizing the first go at these statistics, which I’m copying below.

Unemployed.

Uber must make unemployment payments to three former New York drivers after withdrawing an appeal of a ruling by the state Unemployment Insurance Appeal Board in early February, making the decision final after years of rulings and appeals. The board in July 2018 found the three drivers to be employees for the purposes of unemployment insurance benefits. In other words, even though Uber hired these drivers as independent contractors, the state found they were more akin to employees in this specific context.

The board in particular looked at Uber’s control over drivers, considering how the company dispatched drivers through its app, set fare rates and collects fares from passengers, maintained a five-star rating system and deactivated drivers below a certain threshold, and monitored drivers on breaking, speed, and routes.

“Although Uber contends that it is merely a technology platform that connects Riders to Drivers, its business is similar in many respects to other more traditional car service companies,” the ruling states. “Here, the technology merely replaces much of the duties of an employee-dispatcher to dispatch a trip request solely to the nearest Driver who may accept the dispatched assignment.”

Brooklyn Legal Services and New York Taxi Workers Alliance, which backed the three drivers in the case, hailed the verdict as a “huge victory” for Uber drivers in New York state and “an amazing precedent” for professional drivers seeking unemployment benefits across the US. The two groups are now hoping the state department of labor makes good on a promise to audit Uber to determine whether the company owes unemployment contributions for other “similarly situated” drivers. It’s unclear if and when the state labor department would conduct such an audit and how long it would take, much less what it would find.

CultureOS.

One thing I admire tremendously about The We Company, formerly WeWork, is its ability to sell its narrative. Here, for instance, is a recent New York Times Magazine profile of We, titled “The rise of the WeWorking class.” It is equal parts indulgent descriptions (“the neon and the daybeds and the fiddle-leaf figs, the wallpaper and the playlists and the typefaces”) and pseudo-philosophical commentary (“solidarity among colleagues can give strength and definition to any individual employee’s sense of independence”), a genre We and its “unusually thoughtful and candid public-relations representatives” (also a description from the Times piece) have mastered getting into print, journalists being unable to resist the literary flourishes that come with writing about the modern workplace as high art. The story won’t tell you much you don’t already know, but it contains some colorful moments, for instance:

When I interviewed [WeWork co-founder Miguel] McKelvey not long after the Summit, he had a very fuzzy time trying to explain the meaning of the “eight pillars” of its CultureOS and the relationships among them. But when he noticed that the P.R. representative happened to be carrying a single-use plastic water bottle, he admonished her to be mindful of her own consumption.

Read: disposable plastic water bottles, like meat, are unwelcome at We, a company that cares deeply about sustainability and the environment, values that also happen to be of great importance to the modern urban consumer.

Oh, but wait:

WeWork Cos. chief Adam Neumann, an avid surfer, took the company jet to Hawaii over the December holidays and hit the waves with a surfing legend he admires, Laird Hamilton.

A private jet?

Raised on a communal kibbutz in Israel, Mr. Neumann has long shown a zeal for private jets. WeWork used to lease or charter jets for its founder and chief executive, but that changed last year when it bought a top-of-the-line Gulfstream G650, according to people familiar with the matter. That model jet sells for more than $60 million. Flight records show the jet was in Hawaii in late December.

A zeal for private jets!

That is from The Wall Street Journal, reporting that We recently led a $32 million investment in Laird Superfood, a natural foods business run by Hamilton. The private jet wasn’t really a focus of the story, but the image of Neumann jetting off to surf with his buddy in Hawaii does make a nice foil to his co-founder chiding We’s unusually thoughtful and candid rep for a single-use plastic water bottle, doesn’t it? According to the Journal, the Laird Superfood investment also isn’t the first time Neumann has put We’s time and resources behind his hobbies and personal interests:

Before the recent rebranding, WeWork in 2016 made an early investment beyond offices in Wavegarden, a Spanish company that makes pools with surfing waves. Mr. Neumann in the summers often hits the waves on Long Island before arriving at work, and he has said surfing creates community, the value he says is central to WeWork, say people who have worked with him.

Other investments made at Neumann’s suggestion include energy-drink and coffee-creamer company Kitu Life Inc., and WeGrow, a private elementary school in Manhattan with tuition of up to $42,000 a year, started in haste after Neumann and his wife Rebekah became dissatisfied with schooling options for their five children.

It is truly unclear what the unifying thesis is, other than stuff the Neumanns are passionate about and stuff they can pass off as a business plan. But that has always been the tension at We: what involves passion and what generates revenue. The core business had both, with, yes, its beer on tap and entrepreneurial hot deskers, but now We is trying to compete with office space giants and attract more traditional, blue-chip clients, while also preserving the ethos that made it a Silicon Valley star, and very rich in venture capital funding. And so asked by the Times whether We would contract with a client like Philip Morris, We demurred (culture! ethos!), before talking up its offerings for mid-sized businesses to Reuters for a story a few days later.

This time last year.

What happened with that crazy MIT study on Uber driver earnings

Other stuff.

Uber in advanced talks to buy rival Careem. Voi Technology raises $30 million for e-scooter rentals in Europe. German startup FlixBus buys rival Eurolines. Trustpilot raises $55 million for online reviews. Pittsburgh signs new guidelines on autonomous vehicle testing. Utah clears way for driverless vehicles. Munchery bankruptcy filing leaves little for vendors and gift-card holders. Airbnb says it has more listings than Booking.com. Uber expands rewards program to all US cities. The weirdest items left in Ubers. Uber driver stabbed to death in the Bronx. Uber drivers sue London mayor, allege racial discrimination with congestion fees. Taxi firm in Hong Kong denounced for intended partnership with Uber. Melbourne man admits to choking Airbnb guest to death over unpaid $210 bill.

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can forward it or suggest they sign up here.

Send tips, comments, and IPO thoughts to @alisongriswold on Twitter, or oversharingstuff@gmail.com.