Once again, the plan to send Oversharing on Tuesdays has been derailed by technical problems with TinyLetter. Why do you hate Tuesdays, TinyLetter? Why do you hate me?

Profitable profitable.

Once upon a time, it meant something to be profitable. Specifically, that total revenue exceeded total expenses. Not so in Silicon Valley! Here is a story from Ellen Huet at Bloomberg on the creative definitions tech startups are coming up with for profitable.

Uber said it was profitable in the U.S. and Canada during the first quarter of this year. Lyft said it is "on a clear and defined path to profitability." Postmates said it will be profitable by the end of 2017. DoorDash is “cash-flow positive" in some markets. TaskRabbit will be "profitable profitable" by the end of this year. It "won't be too long" until Airbnb is profitable. Instacart is "gross margin profitable." Luxe Valet is "on the precipice of being profitable" in some markets. At Y Combinator's demo day in March, many bright-eyed entrepreneurs clinched their pitches with a robust "and we're already profitable!"

What these phrases mean is murkier. Uber doesn’t count equity grants to employees, interest or taxes. Lyft and Airbnb won’t elaborate. TaskRabbit defines “profitable profitable” as turning a net profit, but declines to say which specific costs are included. Postmates skips taxes. "You can always say, 'We're profitable if we don't include X,' " Sean Behr, a founder and CEO tells Huet. But "if your bank account ends up lighter than when you started—eventually, that doesn't work."

Elsewhere, venture capitalist Bob Kocher tells Fast Company’s Christina Farr, “I get lied to by entrepreneurs every day.”

Mega-slump.

Over on the venture capital front, research firm CB Insights is declaring a “mega-slump”—i.e., a drop off in the rate at which tech startups are securing funding rounds worth $100 million or more. Since January, there have been 45 deals of that size. That puts the year as a whole on track for 125 such deals, about 30% less than in 2015.

In related things, McKinsey has a new report, “Grow fast or die slow: Why unicorns are staying private,” which notes that tech companies are increasingly achieving unicorn or decacorn status (meaning valued at $10 billion or more) without needing to go public. McKinsey’s analysts attribute this to the VC funding boom of the last few years, as well as the 2012 passage of the JOBS Act. They recommend that startups consider “using IPOs strategically to accelerate growth,” while also noting that “remaining private does have a number of benefits” such as “not disclosing business details.”

Apple invests.

The big news out of tech last week was Apple’s decision to invest $1 billion in Didi Chuxing, the no. 1 ride-hailing player in China. The investment is a significant one, particularly for Apple, whose fortunes in the Middle Kingdom have recently taken a turn for the worse. Quartz’s Josh Horwitz has a good piece on how Didi doesn’t really need Apple, but Apple could use the alignment with Didi—and, by extension, Beijing—to help regain its footing.

Apple’s investment in Didi against Uber is a symbolic appeasement. It’s a bet on the government’s preferred horse, in a competition that ranks alongside Baidu’s fight with Google and Alibaba’s war with Amazon.

There is little reason to expect a deep collaboration between Didi and Apple anytime soon. Beyond app store promotions and Apple Pay integration (assuming the government doesn’t toss it out alongside iBooks), there’s not much that Apple can do to help Didi enhance its already dominant position.

But the investment could mark the first in a series of Apple investments in Chinese tech companies. If Apple can’t popularize Apple TV alone in China, perhaps it will work with Alibaba or LeEco, two Chinese companies working to become leaders in online entertainment. If it can’t bring Apple Music to the Middle Kingdom, perhaps it can find a partner in Tencent’s QQ Music.

At Stratechery, meanwhile, Ben Thompson suspects that Apple’s decision to invest “wasn’t really a decision at all.” The only question, he says, is “whether said choice was one the iPhone maker came to on their own (to curry favor), or if it was dictated to them (invest or else).”

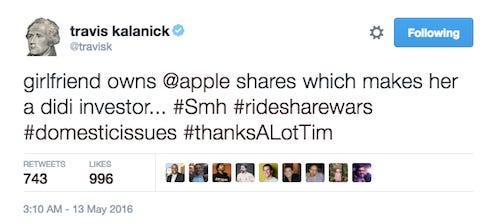

And from Travis:

Arcade City.

Uber and Lyft lost the Proposition 1 vote, but ride-hailing isn’t over in Austin, Texas. Already, companies are popping up to fill the transportation void left by Uber’s and Lyft’s departures last week. One such group, Arcade City, has launched on Facebook and claims to have signed up more than 10,000 people as drivers. Its app is reportedly in the works, and sounds not-the-best:

How it works is riders post if they need a ride and their location, and drivers comment back. The rider gets to choose their driver. Drivers have been posting their Uber and Lyft profiles, so passengers can know a little more about them and their driver rating.

Another prospector is GetMe, a ride-hailing app that said back in December it had no issues with fingerprinted-background checks, and which reportedly doubled its list of driver applicants from 2,000 to 4,000 during referendum weekend.

The real update is on enforcement, though, which the Austin American-Statesman reports simply isn’t happening.

…GetMe drivers haven’t been fingerprinted. And the city isn’t citing anyone for not being fingerprinted: It doesn’t have the mechanism to do so.

In other words, the multimillion-fight over Proposition 1 seems to have overshadowed any practical considerations of what might happen afterward. The ordinance Austin upheld, for example, outlines a schedule for drivers to get fingerprinted (25% by May 1, 99% by February 2017), but says the penalties for failing to do so will come in a separate ordinance. The city council also has yet to define the criminal convictions that would disqualify someone from driving for a ride-hailing service. “We were kind of stopped in that conversation by the [Prop 1] election,” says Austin mayor Steve Adler.

Other stuff.

David Chang launches Ando. People are unhappy at Instacart. Gett undercuts Uber. Google-owned Waze challenges Uber. Lyft doubles class-action settlement. Named plaintiff in Uber class-action objects to settlement. Lyft explains marketing blitz. An Uber falls into a sinkhole (really). IPO target for Didi? Mutual funds at odds on startup valuations. Why startups fail. Why startups have down rounds. “They give their young workers Ping-Pong tables and take away their constitutional rights.”

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can direct them to sign up here. Header art by Maddie Schuette, who is available for hire. Send tips, comments, and your favorite profitability metaphors to oversharingstuff@gmail.com.