What Uber’s drivers really make (hint: nothing like what Uber says)

XLIII

Uber’s unicorn.

Two and a half years after it claimed the median New York driver made $90,766, Uber owes the Federal Trade Commission $20 million for the stunt. The FTC settled with Uber last week on claims that it misled drivers about how much they could earn, and also on the affordability of various auto financing arrangements. Uber didn’t admit to any of the charges, but the FTC is definitely right. Case in point: When I was at Slate dot com, I spent a few weeks asking Uber to speak with some of the drivers earning $90,000 or more in New York City. Seeing as that was the median, it definitionally should have been every other driver off the street. Uber couldn’t find a single one.

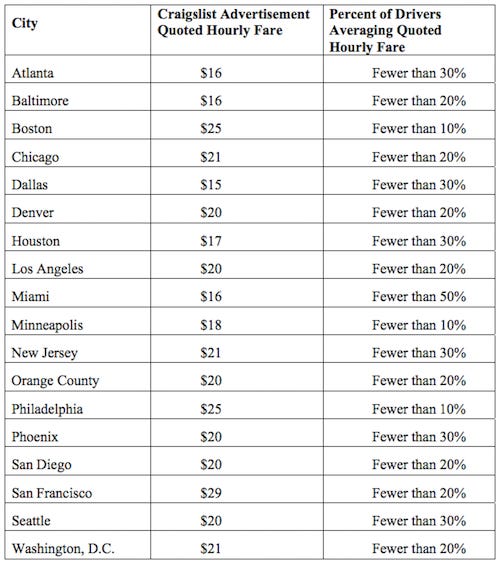

The full FTC complaint is here and I recommended reading it through. Specifically, this chart is enlightening:

That shows the rates Uber advertised drivers making on Craigslist in December 2014 and the share of them that actually did. In Boston, Minneapolis, and Philadelphia, less than 10% of drivers averaged Uber’s promoted rates. In eight of the 14 cities, it was less than 20%. Meanwhile, the FTC also finds that Uber signed thousands of drivers into deals to “own a car for as little as $20/day” ($140/week) or lease one for “as low as $17 per day” ($119/week) when the median weekly payments were actually $200 and $160, respectively.

The FTC has ordered Uber to stop misrepresenting its earnings and financing terms to drivers and, as previously stated, to pay $20 million. Let’s be honest: This is a great deal for Uber. Just as the company has saved incalculable amounts of money by treating its drivers as independent contractors instead of employees (at least $100 million, maybe as much as $1 billion), the value of its deceptive advertising is probably well over $20 million. Churn is high in ride-hailing: only about 50% of drivers stick around after their first year. That means Uber needs a steady supply of new workers, and you can bet advertising high earnings helps with that. The upshot is that Uber got to run with its inflated rates for at least part of 2014 if not longer, as well as build out auto financing programs with iffy terms before regulators stepped in. Uber has rarely pretended to care about its drivers, so it's not like its reputation is going to suffer, and the $20 million penalty is almost negligible for a company that’s raised $13 billion. Gross tactics, yes, but undoubtedly effective.

“Uber Terminal.”

I don’t usually do two Uber segments in the same newsletter, but jeez:

Howard has been parking and sleeping at the 7-Eleven four to five nights a week since March 2015, when he began leasing a car from Uber and needed to work more hours to make his minimum payments. Now that it’s gotten cold, he wakes up every three hours to turn on the heater. He’s rarely alone. Most nights, two to three other ride-hailing drivers sleep in cars parked next to his. It’s safe, he said, and the employees let the drivers use the restroom. Howard has gotten to know the convenience store’s staff—Daddy-O and Uncle Mike—over the past two years while driving for this global ride-hailing gargantuan, valued at $69 billion.

Howard said he makes $12.50 an hour, down from $40 an hour when he started in 2014. The FTC settlement may have barely scratched the surface. I think Bloomberg really nails it with this line: “In a sense, drivers sleeping in their cars typifies, in an extreme way, what Uber said it does best: offer drivers flexibility.” Read the full story here.

Airbnbablement.

UBS is out with a new report on “shared accommodation” that’s almost entirely about Airbnb. A few takeaways:

Airbnb’s growth has slowed. From January to May 2016, average monthly year-on-year growth in listings (hereby known as AMYOY, because that was a mouthful) greatly exceeded AMYOY growth in listings from June to October 2016 in all the countries UBS looked at, except for the US. That’s not to say listing growth is slow—far from it, with double- and triple-digit rates. But it might explain why Airbnb is looking to (Magical) Trips as its next act, lest the trend continue.

Airbnb’s occupancy rates are up ever-so-slightly. In the top 20 cities booked, occupancy averaged 64% in October 2016, up a hair from 63% in October 2015. But those rates are down in Paris, New York, and London, the company’s three biggest markets.

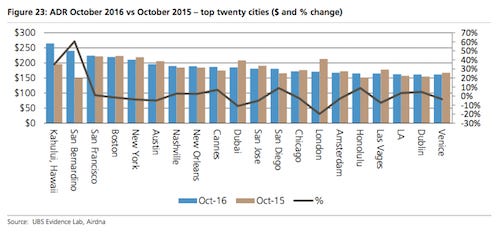

Airbnb’s average daily rates are up 3% in its top 20 cities from October 2015 to 2016, but down 2% globally. In London and New York, average daily rates are down since October 2015.

Finally, UBS asks, is growth in Airbnb bolstering growth in airlines? They think it might be. They call it (brace yourselves) Airbnbablement.

WWSJD?

Here is an interesting indictment of Silicon Valley in the Trump era from Wired:

At least since the 1960s, the computer—and, beyond that, the Internet–has been a symbol and tool of personal liberation … But Trump’s inauguration provides a damning counterargument, an example of how each of those ideas can be exploited to advance the very values they were created to oppose … In designing to maximize engagement, social networks inadvertently created hives of bias-confirmation and tribalism.

And from Kara Swisher at Recode: What Would Steve Jobs Do?

Other stuff.

Uber is over January price cuts. Lyft is not. Laszlo Bock heads to Thumbtack. Rocket Internet raises a unicorn-sized fund. Uber stalls in Hong Kong. Uber sues Seattle to stop drivers from unionizing. Uber raises fares by 20% in Oahu. Nashville may spend $1 million to enforce rules on Airbnb. Google’s Amit Singhal heads to Uber. Deliveroo plans London expansion. SPG devalues Uber rides. Arbitrator says Uber driver is not an employee. SNL spoofs Uber. Machines May Replace Uber Drivers, But Not Your Plumber or Wedding Planner. Rent this island off the coast of Belize for $495 a night on Airbnb. Airbnb for campers. Uber for data scientists. Self-flying air taxis. Adoptly, the Tinder for Child Adoption, Is Indistinguishable From Parody. “If the television series Friends was made today, Joey and Chandler wouldn’t be there—their New York apartment would be permanently rented on Airbnb.”