WeWork will unleash every human’s superpowers

CXXXVII

Hello and welcome to Oversharing, a newsletter about the proverbial sharing economy. If you're returning from last year, thanks! If you're new, nice to have you! Hope everyone enjoyed the winter holidays and is starting 2019 well.

I am not at the Consumer Electronics Show in Las Vegas, thank god, but three of my brave coworkers are. You can sign up for their pop-up CES Daily Brief here.

Also in case you missed it, Oversharing got a theme song, check it out.

The gig is up.

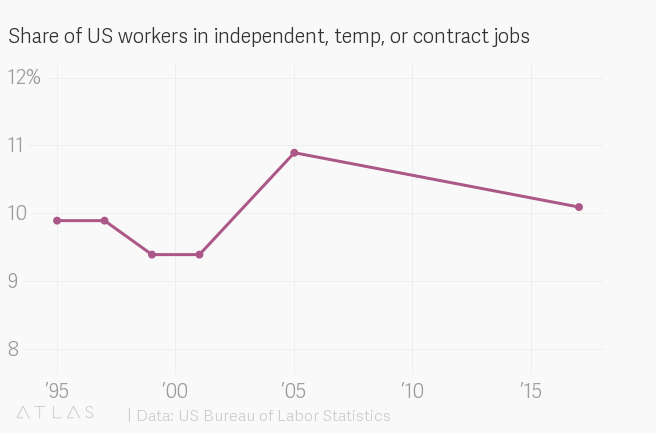

Labor economists Larry Katz and Alan Krueger have amended their 2015 prediction of a gig economy boom in a new working paper (pdf). Where Katz and Krueger initially found a 5-percentage-point increase in gig work from 2005 to 2015, representing almost all US job creation over that period, they now believe it was a more modest 1 to 2 percentage points. Their updated findings follow a June 2018 report from the US Bureau of Labor Statistics that found gig and other alternative forms of work, quite the opposite of booming, had fallen as a share of US workers since 2005.

Katz and Krueger believe their initial estimate was flawed in part because they were observing a reaction to an American economy weakened by the 2008 financial crisis, rather than a permanent shift in the labor market. We have talked before about the theory that Uber, Airbnb, TaskRabbit, and their legions of imitators succeeded early on because of the recession and weak US economy. Airbnb and TaskRabbit got started in 2008 and Uber in 2009, when millions of Americans had lost their jobs, homes, and life savings, and more than anything needed a modicum of financial stability. When jobs were scarce, being able to make money immediately by driving your car or renting a room in your house was a miraculous opportunity. It is less miraculous now that the labor market has tightened, wages are rising, and the liberated lifestyle advertised by gig economy companies has failed to live up to its promise.

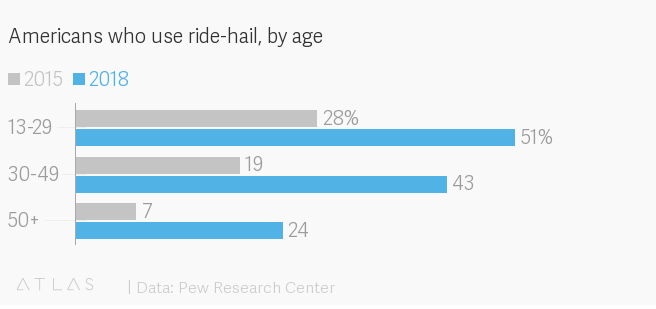

Elsewhere in gig research, Americans are ride-hailing more, but not more often, according to a fall 2018 poll by Pew Research Center. Thirty six percent of more than 10,000 respondents told Pew they have used a service like Uber or Lyft, compared to just 15% who said that in a 2015 survey. Another 61% said they had heard of ride-hail services but not used them. Only 3% of respondents hadn’t heard of ride-hailing at all, down from 33% of respondents who hadn’t in 2015. While more Americans have now tried ride-hail services, the share that use them weekly or almost daily remains low, at 4% and 2% of US adults, respectively.

From 2015 to 2018, ride-hail use grew across most US adult demographics: age, education, and household income. (Pew didn’t break out race.) But as in 2015, young, educated, and relatively wealthy Americans made up the bulk of those users.

Ride-hailing, in other words, is not exactly democratic, but is more accessible than might be expected, even to people from lower income households. This makes sense considering how widespread smartphones have become—more than 75% of Americans own one—and how companies like Uber and Lyft have focused on introducing lower cost ride options like Uber’s Express Pool. To drive somewhere you need a car; to Uber somewhere you need a smartphone, a payment method, and the Uber app.

The wider gap in ride-hail use in America is between rural and urban populations. Only 32% of US adults who earn $75,000 or more in rural areas take ride-hail services, for instance, compared to 71% of adults in the same earning category in urban areas. That gap could reflect that services like Uber and Lyft are less available in rural areas, or that people in rural areas are more likely to own a car and therefore have less need for a ride service. Rural areas also aren’t conducive to shared ride services like UberPool, which work best in high-density areas where the company can match up enough people traveling in roughly the same direction to keep wait times and prices low, while paying the driver enough to make the job worthwhile.

WeBranding.

WeWork is rebranding as “The We Company,” it announced today, in a blog post that contains the word “we” more than 60 times. “The We Company’s guiding mission will be to elevate the world’s consciousness,” co-founder and resident cult leader Adam Neumann writes. “Living a conscious life means choosing to live proactively and with purpose. It means being a student of life, for life, where we accept that we are always growing and in a constant state of self-discovery, self-growth, and change.”

Elevating the world’s consciousness is understandably a big mission, which is why Neumann has broken it down into three more manageable sub-missions:

WeWork’s mission is to create a world where people work to make a life, not just a living. WeLive’s mission is to build a world where no one feels alone. WeGrow’s mission is to unleash every human’s superpowers.

Making a life! Ending loneliness! Unleashing superpowers! We—WE—are living in an era where “unleash every human’s superpowers” is a real thing that a real technology company backed by billions of real dollars can claim it is working to achieve. Sometimes I wonder whether the communications people who write and approve these statements roll their eyes or at least consider that instead of sounding inspiring, they evoke the ramblings of a deranged super-villain intent on reshaping the world. I look forward to Wefinity Wars, coming out from Marvel in summer 2020.

All this talk of world consciousness and superpowers also conceals a more sobering reality: WeWork failed to land a much-hyped $16 billion investment from Japanese tech giant SoftBank, settling instead for an investment of about $2 billion. The money brings SoftBank’s total investment in WeWork to about $10.5 billion. Half of the $2 billion went in at a $20 billion valuation and half at a previously announced $42 billion valuation, the Financial Times reported. This is similar to the trick SoftBank pulled with Uber when it bought existing shares at a $48 billion valuation but committed $1.25 billion in new funding at Uber’s previous valuation of $68 billion, so that the company could pretend its lofty valuation remained intact.

Why might SoftBank be alarmed? The Wall Street Journal reported that WeWork—I mean, The We Company—sustained heavy losses of $1.2 billion in the first nine months of 2018. It is also unclear how the company would fare in a global economic downturn, which some investors are predicting for 2019. Neumann characterized the smaller investment as an opportunity and compared his company to a diamond, telling Fast Company, “to make something very precious, you have to apply a lot of pressure.”

IPO no-go.

The ongoing government shut down may be holding up the IPO market, Fox Business reported:

While bankers have been working feverishly to get IPOs ready, Securities and Exchange Commission officials tasked with approving those IPOs haven’t been working at all the past 17 days as the partial government shutdown continues — a reality that could derail one of the biggest quarters for IPOs in years.

FOX Business has learned there is a backlog of more than 41 IPOs that need to be reviewed by the SEC before they can go public, according to data from Dealogic. The actual number of IPOs ready for review may be higher since many companies choose to file confidentially.

Several big-name technology companies are expected to go public as soon as the first half of 2019, including Airbnb, Pinterest, Palantir, Uber, and Lyft. The threat of market volatility and an economic downturn has also spurred some companies to file faster than they had originally planned. An SEC backlog from the partial government shutdown could inconvenience companies looking to get their offerings moving. On the other hand, richly funded companies like Uber are in a lot better shape than the more than 800,000 federal employees who could go unpaid because of the shutdown—some of whom are now driving for Uber.

Books!

I read a lot of delightful books in 2018 and, in the spirt of oversharing, am sharing some of my favorites here with all of you:

Less - Andrew Sean Greer

Literally everything by Mohsin Hamid (start with The Reluctant Fundamentalist or Exit West, but How to Get Filthy Rich in Rising Asia is also excellent)

Everything I Never Told You - Celeste Ng

Bad Blood - John Carreyrou

Homegoing - Yaa Gyasi

My Name Is Lucy Barton - Elizabeth Strout

The Ice Palace - Tarjei Vesaas

When the Emperor Was Divine - Julie Otsuka

Last Things - Jenny Offill

Your recommendations welcome as I work on my reading list for 2019.

This time last year.

SoftBank's uber-popular Uber bid, movie theater slammed for surge pricing, restaurant pods

Other stuff.

Didi launches in-app financial services in China. Mercedes wants to lead in scaling autonomous tech. Dan Ammann becomes CEO of GM Cruise, Mark Reuss named GM president. Judge Blocks Airbnb Crack Down in New York City. Montreal Cracks Down on Illegal Key Boxes for Airbnbs. Chicago Transit Authority bus ridership down 26% since 2008. Meera Joshi resigns from New York City taxi commission. Amazon Go could be $4 billion business by 2021, report finds. U.K. Restaurant Delivery Is Worth an Astonishing £8.1 Billion. Uber launches e-bikes in Atlanta. Uber partner debuts flying taxi design at CES. Uber CEO funds indoor farming startup. Postmates accidentally sends man $500 million check in class-action settlement. Bradley Tusk seeks $70 million for second fund. Startup Founders Say Age Bias Is Rampant in Tech by Age 36. Grabango raises $12 million for checkout-free technology. Kansas highway patrol say Uber and Lyft lights are illegal. Uber charging $25 fee for e-bikes left outside of Seattle zones. Uber driver pleads guilty to killing six people in 2016 shooting spree. Aging BART cars could be rented out on Airbnb. Palantir claimed its terrible diversity figures were a trade secret. Jeff Bezos and Jamie Dimon are best frenemies. Costco selling 7 pound nutella tubs.

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can forward it or suggest they sign up here.

Send tips, comments, and book recommendations to @alisongriswold on Twitter, or oversharingstuff@gmail.com.