Shorting Uber.

Last week was as good a one as any to question Uber’s $62.5 billion valuation: Uber lost China to Didi Chuxing, and Grab was set to raise $600 million in new funding to go up against Uber in Southeast Asia. Suddenly, the vision of Uber as the sole winner of the global ride-hailing market no longer looked certain. Here is Steve Levine in Quartz:

Notwithstanding how often it is repeated, the central Uber thesis—that half the population will eschew car ownership, and that we will be surrounded by robotic taxis by the early 2030s or so—is not in fact axiomatic. Uber does have a solid business, but it is not manifestly a new Amazon, Facebook, or Google, a behemoth poised to sit athwart the next big thing. It could reasonably end up as merely a more massive Hertz with a better phone app, albeit one that delivers sushi or enchiladas from the local restaurant.

His piece is “Investors have placed a one-way bet on Uber—which made us want to find a way to short it” and really there are two questions at stake. One, is Uber overvalued? Two, how do you short a private company that has done its utmost to make shares illiquid? It’s an interesting thought experiment and worth reading, though be warned it’s also a bit finance-intensive. (For example, there is a discussion of credit default swaps, the financial contracts that figured prominently in the housing crash, but there is also a picture of Ryan Gosling in the Big Short.) Steve evaluates Uber as it is today—a taxi disrupter betting that “shared mobility” and self-driving cars will help it displace car ownership. When Uber’s most bullish investors talk about the company’s prospects, on the other hand, they tend to envision it as those things plus a logistics platform.

And here is Chris Mims in the Wall Street Journal: Why Uber Might Stalk an IPO Sooner Rather Than Later.

Jettisoned.

Walmart is buying Jet.com for $3.3 billion and while I know this isn’t strictly part of the “sharing economy,” it’s big news and let’s categorize it as “startup dreams deferred.” Jet.com launched a little over a year ago with ambitions of taking on Amazon, lots of funding, and even more purple. Seriously, you should see it headquarters in New Jersey. Purple seats, purple lighting, a single purple bike hanging from a rack on the wall. Jet was initially going to sell a subscription similar to Amazon’s Prime, but it quickly scrapped that and decided to focus on acquiring customers through low prices alone. Frankly, this was a weird way to go about things because, like, Amazon stopped playing that game years ago. The Amazon of today makes its money from (1) Amazon Web Services and (2) Amazon Prime. Amazon doesn’t need bottom-out prices to attract and retain users, but if it did ever feel like ruthlessly undercutting Jet, that wasn’t going to be a problem.

Anyway, after Jet dropped subscriptions, it was never really clear how it intended to make money, and it seems like Jet never really figured it out. And neither did … its investors?

Several have told Recode privately that they thought the chances of a successful outcome were slim to near-impossible, even with the background of Lore and his co-founders.

Well. Good.

“Is the Sharing Economy the reality?”

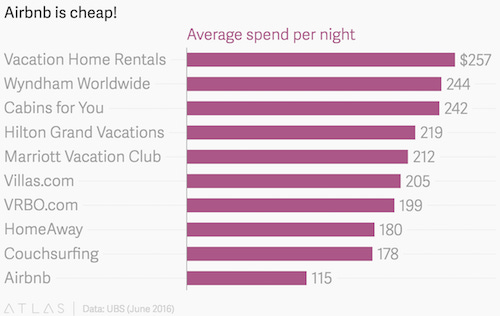

This is a real subhed in a report that UBS released last week and a good reminder that we should all question our realities more often. (The answer from UBS, if you’re wondering, is “Yes, it is…”) The report has some interesting stuff on Airbnb, including that the average price for a night in a shared accommodation is much cheaper on Airbnb ($115) than on any of the other hotels or home-rental sites UBS examined. Strangely, even Couchsurfing is more expensive. The chart below is non-exhaustive, but you get the idea.

There is also a very scary finding for the hotel industry: “compression nights”—i.e., nights where hotels are essentially sold out, with occupancy topping 95%—were down across the US in 2015. Another way to think about compression nights is just high-demand booking periods, like the holidays. Hotels hike rates during these nights and rely on them for an outsize portion of revenue growth. UBS thinks they are less able to do that now because travelers faced with exorbitant prices will just turn to Airbnb instead. Say what you will about Airbnb, but that seems like a pretty clear win for consumers.

NEWYORK55.

Several publications last week “obtained” a letter from Lyft to investors showing that business at Lyft is awesome! July was a “record month” for Lyft, which did 13.9 million rides, had more than 3 million monthly active passengers, and passed $2 billion in total fares paid by riders. This extremely rosy letter just so happened to be “obtained” by the press one day after Didi announced it had bought Uber’s China unit and was investing $1 billion in Uber, a deal that only bodes poorly for Lyft. Draw your own conclusions.

Meanwhile, in other Lyft news, yesterday while I was walking around Flatiron in Manhattan I came across a pair of guys who were handing out vouchers for Lyft on the street. Turns out, they had scratched out the original voucher code on each card and replaced it with their own, “NEWYORK55.” That is the entrepreneurial spirit. I took one and the first man encouraged me to share it with all my friends, so obviously I am sharing it here with all of you. I asked him why he had changed the code and if he earned credit when it was shared. He shrugged and asked why I was asking so many questions.

Other stuff.

Canadian unicorn is cash-flow positive. Deliveroo is Europe’s newest unicorn. Grab valuation could climb to $2.3 billion. Airbnb raises $850 million for valuation of $30 billion. Taiwan may kick out Uber. Why China never banned Uber. Bill de Blasio’s Progressive War on Uber. Seattle wants more time to organize ride-hailing drivers. Uber left Austin to protest regs, is mapping it anyway. Uber, Lyft spend big on New York lobbying. How 3 Minutes Can Save You $14. Charlie Baker signs Massachusetts ride-hailing regs. Google loses top self-driving car roboticist. Happened in an Uber. Add a Stop. Uber but for power tools. Airbnb Fathom cruise. Mayo scams. “If we all sit in the ivory tower in San Francisco, we cannot imagine how challenging the local conditions are.”