Stop trying to make fetch happen.

Uber has always touted its organic user growth but the fact of the matter is that like any other company, it also relies on ads. From January 2015 to sometime in 2017, Uber contracted with mobile advertising agency Fetch to deliver some of those ads. Fetch bought ads for Uber directly in the US, Mexico, France, the Philippines, Romania, and Singapore, and indirectly in assorted other countries. Uber paid Fetch for “legitimate clicks” that resulted in Uber app downloads, user signups, and first trips being taken. From 2016 through Q1 2017, Uber paid Fetch $82.5 million.

All was well until early this year, when Uber noticed its ads appearing on Breitbart, a far-right news site that was supposed to be blacklisted, but showing up as though they’d come from other places: “Magic_Puzzles,” “Battleship_War_30,” “Snooker_Champion.” Then, in March, Uber suspended its entire Fetch campaign, but saw no drop in overall app installations. The number of installations attributable to paid mobile ads fell, but the number of organic installations rose by almost the same amount.

Uber is now suing Fetch for about $40 million for fraud, alleging it was actively misled as Fetch “squandered tens of millions of dollars to purchase nonexistent, nonviewable, and/or fraudulent advertising.” “With Fetch, we learned the age-old ‘buyer beware’ the hard way,” Uber says in a statement. “Fetch was running a wild west of online advertising fraud, allowing Uber ads on websites we wanted nothing to do with, and fraudulently claiming credit for app downloads that happened without a customer ever clicking on an ad.”

I am not a lawyer, but if you ask me this lawsuit seems great for Uber. It thought it was paying money for ads to drive growth and then it found out that it was paying money for ads that weren’t driving much growth at all and were just claiming to drive growth that was happening organically all along. That is great for Uber! I can hardly think of a better way to justify your organic growth story to investors. I mean, the entire complaint is basically an ad for how terrific Uber’s organic user growth is. I think Fetch did an amazing job. You can’t buy advertising that good. Or, I guess you can, but perhaps not in the way that you initially thought.

Et tu, Google?

Alphabet neé Google and Uber used to be friends, but that was before Uber hired the engineer who allegedly stole 14,000 confidential files on Alphabet’s self-driving car work. Now the two companies are headed to trial after months of litigation and Alphabet is contemplating a $1 billion investment into Uber’s chief US rival, Lyft.

It used to be cool to be worth $1 billion; now it’s in vogue to raise $1 billion. A lot of those giant pools of money have lately come from Japan’s SoftBank, which at this very moment is weighing its own investment of up to $10 billion into Uber. SoftBank is looking at buying 17% to 22% of Uber through a combination of share purchases from the company and a tender offer to employees and investors, the latter at a discount of 30% or more. Uber investors have “expressed concern that the process could devalue the company” so SoftBank is also offering a direct investment into Uber at its current valuation of about $68 billion, instead of the discounted $50ish billion valuation, because that is apparently how these things work when you are a private company and your financials are finagled with some combination of optimistic math and black magic.

Both the Alphabet-Lyft and SoftBank-Uber investments would complicate an already complex web of investments into ride-hailing companies. Alphabet is an early investor in Uber through its GV venture capital arm and SoftBank has previously backed ride-hailing firms Didi Chuxing, Grab, Ola, and 99, which compete with Uber in global markets. It’s hard not to see the Alphabet bid for Lyft as fuck-you money to Uber. SoftBank, meanwhile, insists that it has a “secular thesis” and that its strategy isn’t simply to “bet on every odd number at the roulette table.”

Airbnb a serf.

Usually when you hear about shady stuff happening in the sharing economy it comes from the “labor” platforms, i.e., companies like Uber, Handy, Postmates, etc., that rely on the labor of independent contractors for their businesses. Those are the people that you hear about getting stiffed on wages and benefits and locked into predatory loans. Shady stuff still happens on “capital” platforms like Airbnb but it tends to have more to do with local regulations than individual exploitation, and questionable lending arrangements usually don’t come into the picture. Yifan Zhang and her Seattle-based startup Loftium are trying to change that:

It will provide prospective home buyers with up to $50,000 for a down payment, as long as they are willing to continuously list an extra bedroom on Airbnb for one to three years and share most of the income with Loftium over that time.

Three years! Loftium homeowners are allowed eight “freebie” days a year or 24 days over the entire term without strangers in their home. They can also cancel up to three guests per year if they feel uncomfortable about the person (a fourth sketchy guest and you’re apparently out of luck). Loftium collects roughly two-thirds of the money its hosts earn through Airbnb. If the homeowner decides they want to stop renting out a portion of their home before the contract ends, they must pay their share of the nights remaining plus 15% within a week, or else Loftium can put a second lien on the house, behind the mortgage lender.

Mortgage lenders are doing all sorts of weird things these days to get debt-burdened millennials back into the home market. They’ve tried avocado toast and now I guess are selling the shared lifestyle. “A lot of people who like this idea are already living with their roommates or their parents, so this is a better situation for them,” Zhang says. That is one way to frame it, though to me this arrangement also has echoes of the subprime car leases that Uber funneled poor and immigrant drivers into in New York. Those leases were “flexible and affordable” so long as the drivers kept working for Uber, which deducted weekly payments directly from their earnings. They could also take days off, but if they fell too far behind, the car might get repossessed. Loftium might also want to pay more attention to local home-sharing regulations. In Seattle, they’re looking at making home-sharing hosts pay $10 a night for every night they rent.

Grocery’s digital divide.

There’s still one big reason why people aren’t buying groceries online, and it’s that they prefer to pick them out themselves.

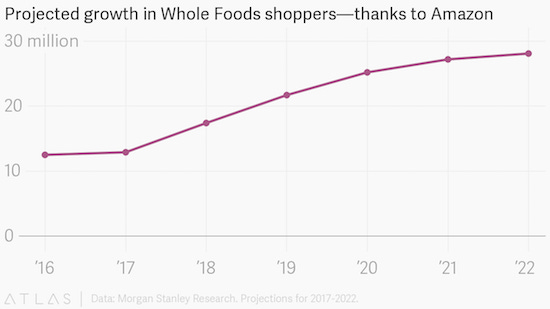

That’s from Morgan Stanley, which also thinks that Amazon Prime could more than double shoppers at Whole Foods over the next five years.

Deloitte, meanwhile, finds in a recent report that 80% of US shoppers “have used a digital device to browse or research grocery products” but that only 33% say digital grocery shopping makes their lives easier.

Other stuff.

Waymo asks to delay Uber trial. Portland concludes investigation into greyball. Uber “here to stay” in Asia. Didi adds Apple Pay. Uber hires Jon Thomason from Oculus. Salle Yoo resigns from Uber. Expedia’s Burke Norton expected to join Uber. Uber pushing hard for CFO. Uber forced to hand over due diligence report to Waymo. How Bozoma Saint John Plans to Fix Uber’s Brand Problem. Lyft expands Shuttle routes. BlaBlaCar gets into ride-sharing. Big Basket raises $280 million. Ease gets $27 million to help deliver pot. Hilton exec shrugs off Airbnb. Wellesley Neighbors Outraged by Airbnb “Dance Club.” Former Uber contractor sentenced for giving himself $25,543 in free rides and food. Ford teams up with India’s Mahindra. Man posing as car seat was working for Ford. Uber hits 1 million autonomous miles. Self-driving Uber crashes in Pittsburgh. Ford invests $5 million in driverless car test site. This Silicon Valley Startup Wants to Replace Lawyers With Robots. Public libraries are the real sharing economy. Amazon’s nomadic retiree army. Uber for movie-makers. Uber for waste. Airbnb for satellite antenna. Shared sex dolls. “Amazon is really about to run the world for millennials.”