Uber scales back UberRush, regulation trips up Airbnb, and inside Blue Apron’s meal-kit machine

LIV

Surge problems.

Uber is shutting down UberRush service for restaurants on May 8 and asking them to switch to UberEats instead. Rush is Uber’s backend logistics and courier platform, Eats its designated food delivery app. Both are part of Uber’s non-rides division, UberEverything, which in other news is no longer the most sinister of Uber’s internal names (see: Greyball, Hell).

So what, as my mom asked? The key point seems to be that even Uber has had trouble making Uber-for-X work. In this case, Uber has struggled to balance its core rides business with other on-demand services that, at times, rely on the same network of drivers and couriers. “We got into a situation where dinner rush would mean a lot of people were taking food deliveries, but then they weren’t driving for UberX, so it was causing surge pricing,” a former employee told me. “We were attacking our own business.” I mean yikes that is not great and maybe don’t take Uber too close to dinner.

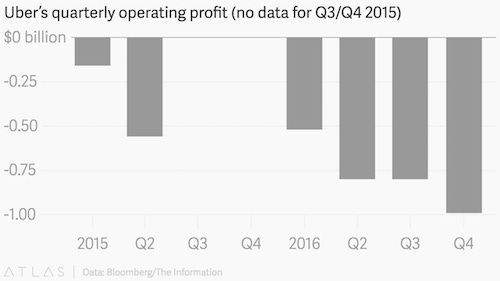

Restaurant orders are more valuable to Uber on Eats than on Rush. With Eats, Uber collects a delivery fee ($5 in most cities), a cut of around 30% from the restaurant, and a cut of 25% to 30% from the courier on each order. On Rush it gets only a flat mileage-based delivery fee. Eats orders also come in through Uber’s app, which means Uber can book all of that as revenue, or gross merchandise value (GMV), a number startups often tout to investors when they seek funding ($1 billion sales run rate!). Rush deliveries are typically placed through third parties, so Uber’s revenue is only the delivery fee. Uber is surely interested in growing its revenue on Eats, having told Bloomberg just last week that revenue growth is outpacing losses in the company’s overall business, though those losses are still quite big.

Meanwhile, DoorDash wrote me to say DoorDash Drive, their UberRush equivalent is doing well (the exact word was “outstanding”) with “hundreds of merchants” making “large and complex” deliveries every week. And here is more from Adam Price, CEO of Homer, a logistics startup in New York, who feels that platforms “with a consumer-facing channel cannot provide a repeatable and acceptable delivery experience to local businesses if they try to utilize their courier fleets across multiple ordering channels.”

Wilted parsley.

Continuing on with food tech, here is a story from Bloomberg “Inside Blue Apron’s Meal Kit Machine.” Bloomberg is rather keen on this headline construction, having last year alone taken us “Inside Uber’s Auto-Lease Machine,” “Inside NASA’s Social Media Machine,” “Inside the Ralpha Marketing Machine,” and “Inside a Moneymaking Machine Like No Other.” Anyway, the Blue Apron machine is very large ($750 to $1 billion in revenue last year) and very expensive to run (“high costs to acquire customers prompted the company to postpone an initial public offering in December”). It’s also quite sensitive:

Attracting and keeping customers is Blue Apron's foremost challenge. It's not easy persuading people to pay $240 to $560 a month for a service that saves time shopping when there are still faster, cheaper ways to get fed. Plus, to keep existing customers happy, Blue Apron must continually improve its offerings with new recipes and more customization. The bigger Blue Apron gets, the harder it becomes to maintain quality, and the more things can go wrong. Subscribers are always one or two bad experiences—a late arrival, the wrong food, wilted parsley—from canceling.

My biggest question about Blue Apron has always been this: Blue Apron says its goal is to teach you how to cook. So it sends you farm-fresh ingredients and glossy recipe cards with step-by-step instructions on preparing a meal. But if you signed up for Blue Apron to learn how to cook and the company really succeeded, wouldn’t you stop using Blue Apron? The alternative theory is that people use Blue Apron mainly to avoid the mental toil of coming up with new recipe ideas and purchasing the ingredients. As someone who eats the same thing for dinner at least twice a week I buy this more but am still skeptical. So is this former Blue Apron user that Bloomberg dug up:

Leslie Burns, a 52-year-old community volunteer from Boulder, Colorado, tried Blue Apron after a friend recommended the service as a way to try new recipes. She lasted three months. The meals often didn't resemble the photos, and she found the portions too small. What pushed her over the edge? All the boxes and bags required to keep the food fresh and unblemished. Hers is a sentiment shared by many current and former customers. “I just felt so horrible at the end of the week, taking my stuff down to the curb," Burns says. "It felt so decadent, a physical reminder of what I was doing. It just seemed not necessary.”

Elsewhere: Blue Apron Has Been Dinged For A “Serious” Worker Safety Violation—Again.

Fare play.

Back to Uber! We talked last week about how Uber’s upfront pricing is not always so upfront. Uber charges riders at the time of booking by guessing what a trip will cost. But it calculates driver pay based on actual miles and minutes. Sometimes a rider pays less than the metered rate and Uber eats the loss. Other times the rider pays more and Uber pockets the difference.

Drivers it turns out don’t like that Uber sometimes pays them from a lower fare than what the passenger is charged. So they’ve worked out a trick. Drivers take screenshots of their fare on Uber’s rider app and then compare it to what they see at the end. If the fare on the driver app is lower, they send the screenshots to Uber and the company sends them more money. Uber says it’s not company policy to refund these drivers, but it seems to work anyway. “When a driver sees that they’ve been underpaid and complains, they always get their money back,” Ryan Price, director of the Independent Drivers Guild, a non-union group that represents Uber and other professional drivers in New York, told me. “I don’t know what to make of that, but it happens constantly.”

Uber says upfront pricing is designed to break even over many trips. This is especially true if you account for UberPool trips with only one rider. Even so, you can’t blame drivers for being suspicious. Uber has touted false claims about earnings, cut wages (while insisting lower rates would benefit drivers), undermined organizing efforts, and refused to facilitate tipping. It’s hardly earned the benefit of the doubt.

Red tape.

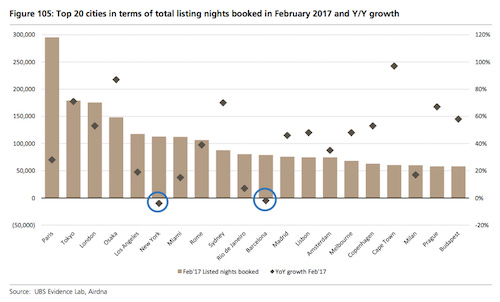

UBS fears regulation has finally caught up to Airbnb. UBS’s research division found that Airbnb bookings declined year-over-year in February 2017 in New York and Barcelona, two of the most heavily regulated cities for short-term rentals. “We believe that regulation enforced in January 2017 in New York and November 2016 for Barcelona is likely the reason,” UBS writes. “While the recent data is not conclusive, it does appear that new shared accommodation regulation is having a negative impact on Airbnb growth. We believe Airbnb is still likely a threat to hotels, but think the change in regulations has reduced the magnitude of the threat.”

That should be welcome news to the hotel industry, which has a “multipronged, national campaign” to thwart Airbnb, according to a recent story in the New York Times. I was a bit surprised the Times published this story because (a) there wasn’t really anything new and (b) it’s the kind of thing that Airbnb shops around to reporters all the time, but I suppose they had their reasons.

Other stuff.

Rachel Whetstone departs Uber. Robots deliver for Eat24 in San Francisco. Instacart tests new tipping display. GM building center for autonomous cars in San Francisco. Apple gets permit to test driverless cars in California. AAA launches car service called Gig. Uber is buying up IP. Uber relaunches in Taiwan. Italy halts Uber injunction. Airbnb sues Miami. Uber faces fine for failing to investigate drunk-driving complaints. Sao Paulo judge rules Uber driver is employee. Uber mulled legal risks for months before buying Otto. New York may force Uber to add tipping. Thailand’s Airbnb raises $2.88 million. BestMile adds another $2 million. Startups are rediscovering the benefits of being profitable. Self-driving taxi startup Voyage will give free rides. Uber for pregnant women. Airbnb for burglaries. The fault in five stars. Glamping killed Coachella. “We’re beginning to see some Uber moments in finance.”