“Stronger together.”

So wrote Travis Kalanick after Uber called it quits in China on Monday (Aug. 1), ending its long and costly battle with Didi Chuxing, China’s most popular ride-hailing service. Didi acquired Uber’s China unit, or if you ask Uber, its China unit merged with Didi. Either way, Uber is getting a roughly 18% stake in the new UberChina-Didi conglomerate and Didi is making a $1 billion investment in Uber. Keep in mind that Didi last fall also invested $100 million into Lyft, not to mention two other ride-hailing companies, which I guess means that everyone is now part of one big, extended, happy (?) ride-hailing family.

Anyway, I am not a China expert, but here are a bunch of smart takes on the buyout-slash-merger from people who are:

Uber’s merger with Didi shows just how hard it is for a foreign company to compete in China

Grab CEO: Didi victory shows we can beat Uber in Southeast Asia

Didi’s founder is the company’s only supervoting shareholder (paywall)

Uber’s defeat in China is bad news for Chinese drivers and riders

China finally made ride-hailing legal, in a way that could destroy Uber’s business model (slightly older, but relevant)

Also, this FT article, just for the quote from Didi president Jean Liu: “Uber has been a grand rival and we have had an epic battle… We raged an earth-shaking war, and when we join hands, our love will last till the end of time.”

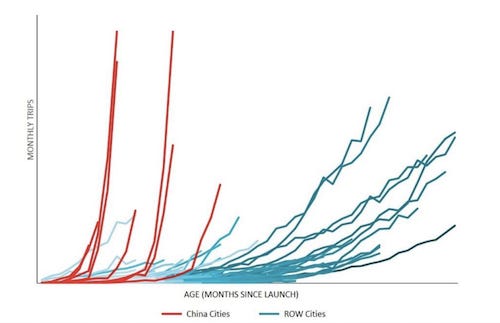

Lastly, I would really like someone to update this chart that Travis sent around to investors last summer touting Uber’s “unprecedented growth in China.” At first I figured the red lines would now slope down, but on second thought that was wrong. This chart doesn’t represent Uber’s growth in China but rather its global ambitions, and the realities of data or standard mathematical functions simply don’t apply. Aspiration is a straight line pointing up.

Et tu, Didi?

…is, I can only imagine, what’s being said at Lyft HQ after Didi appeared to align with it last fall—and by extension against Uber—then turned around and made an investment in Uber that in monetary terms alone is 10x its stake in Lyft. Even setting this tie-up aside, the Uber deal with Didi is an ominous sign for Lyft. China was by far the biggest strain on Uber’s finances and Didi its fiercest competitor. Now, that burden has been lifted, and that competitor turned into something of an ally. Ceding China wasn’t a complete loss for Uber, but the company may well want a clearcut victory to reassert its strength. The US is a natural target. In the post-China world, Uber is free to train its firepower on other opponents, and in the US that means Lyft.

I’m With Sharing.

If you went to the right events at the Democratic National Convention, you could have been forgiven for thinking it was to elect the sharing economy rather than Hillary Clinton. On Tuesday (July 26) Airbnb released a new poll it conducted which found that people really don’t like homesharing very much. No of course it didn’t. It found that “Americans nationwide support the sharing economy and Airbnb.” Also, that “millennials—including millennials in swing states—are even more supportive of Airbnb and the sharing economy.” DID YOU GET THAT, HILLARY? SWING-STATE MILLENNIALS. Meanwhile, Uber partnered with the DNC to ferry VIPs around Philly, and reportedly bullied Lyft and taxi drivers away from the convention center. “We did get reports of drivers who were turned away at the perimeter by someone wearing an Uber shirt,” says Lyft spokeswoman Chelsea Wilson. Never forget that ride-hailing is war.

Taxes.

Airbnb is doubling down on its campaign for cities to let it pay taxes. On Monday, the company began collecting and remitting tourist taxes in 17 cities in France. Closer to home, Airbnb has bought a radio spot in Massachusetts to support a tax bill pending there that includes the line, “if Massachusetts families pay taxes, we should too.” Airbnb is bent on paying taxes because doing so is its best overture to cities, a way of saying, “Hey, we want to help you out, and maybe you should help us out a bit too.” Airbnb notes that it has paid over $110 million in hotel/tourist/occupancy taxes worldwide since 2014 and ok, gold star I guess, but then again $110 million in taxes worldwide for a $30 billion startup doesn’t seem like a whole lot? Also, there was that report a few months ago about Airbnb diverting most of its profits to a tax shelter in Ireland, but details.

Other stuff.

Instacart debuts in Dallas. Shipt takes on Instacart in the Southeast. Uber’s $500 million mapping project. Massachusetts passes Uber regs. Lyft hires head of consumer comms. Lyft launches in Portland (Maine). Lyft launches in Grand Rapids. Via goes to Washington. New York MTA complains about Uber, Lyft. Ride-hailing approved by the GSA. The Ergo plot thickens. For Tech IPOs, Safe Is the New Sexy. Driverless cars threaten auto insurers. Lorde took an Uber. Peter Thiel is a vampire. Theranos problems. Good Uber samaritans. Ola Fleet. Uber driver timeouts. White-glove lenders. “Different flavors of Prime.” Pay with Venmo.