2017.

As promised, here are some of those sharing economy predictions I asked for last week. I didn’t include them all but the things on most people’s minds were pretty clear: (1) Uber’s unprecedented losses. (2) Trump.

Roger Dickey, CEO of Gigster: Freelancing will start to look more like a full-time job, with team membership, career progression, guaranteed earnings, and a sense of community.

Jeff Wald, president of Work Market: President-Elect Donald Trump will dismantle Obama's "Misclassification Initiative." In 2010, President Obama started a task force to root out misclassification in the labor force… We believe that this will not be a priority of the Trump administration nor Republican congress, and that they will scrap this task force and cut funding to the 35 state departments that have been working to reduce misclassification.

Hunter Walk, partner at HomeBrew: While early market heat focused on B2C companies, 2017 will see the B2B players get their due as business budgets increasingly shift towards high quality, fair-priced service providers such as ManagedByQ and white collar labor marketplaces like UpCounsel. (Note: MBQ and UpCounsel are both in Homebrew’s portfolio.)

Harry Campbell, The Rideshare Guy: Uber starts to lose market share… as Uber starts to shift towards profitability and focuses their fundraising narrative more on emerging markets like Southeast Asia, Latin America and India, they won't have the money to outspend their competitors. We saw this play out in 2016 in China where Uber finally met another company that could match/exceed it when it came to operations and spending and the result was Uber's first real 'defeat' in the rideshare space.

Oversharing reader: Uber and Lyft are going to make moves to lose less money. Losing $3B a year isn’t fun. That means lowering commissions for drivers. That will lead to more organized driver strikes in the car sharing space, and potentially longer waits for pickups.

Another Oversharing reader: The IRS (via the urging of the democratic minority in congress) will allow "sharing economy" (gig economy) platforms to offer health insurance without violating 1099 status. This will be a preemptive concession of republicans as they try to dismantle Obamacare. Hopefully that doesn't happen.

A difference of opinion.

Here is a great pair of letters to the editor that ran in the Financial Times on Jan. 5. The first, “Home-sharing is an economic lifeline for many,” responds to an FT editorial critiquing tax treatment of Airbnb in London, and would you believe it’s written by someone who works at Airbnb? Patrick Robinson, Airbnb’s EMEA director of public policy, notes that most Airbnb hosts in London “are not businesses or hospitality professionals” but rather “regular people who share their homes to help afford living in one of the most expensive cities in the world.” He gets in some statistics about how much the average host earns, and how Airbnb collects and remits tourist taxes in applicable cities. Also, lest we forget, “home-sharing is an economic lifeline for thousands of Londoners.” (If nothing else, that policy team really stays on script.)

The second is from Michael Jacobs, director of the IPPR Commission on Economic Justice, a progressive UK think tank. It’s shorter and punchier, tackling an FT article that claimed Airbnb will “miss out” on $400 million worth of bookings in London in 2017 when a new 90-night limit for hosts takes effect. Airbnb, Jacobs argues, is not “missing out” on this money. “If it did not do this, and made such money instead, it would be profiting from illegal behaviour—as some of its competitors may well be doing,” he writes. “What’s next? ‘Companies missing out on millions by complying with minimum wage?’”

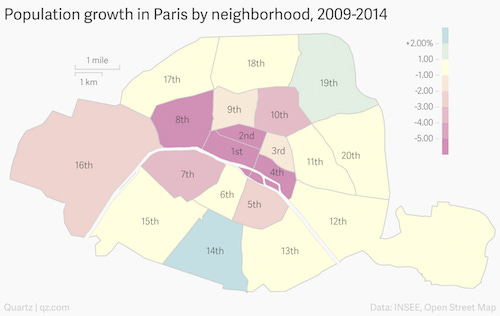

Elsewhere: Paris is blaming Airbnb for population declines in the heart of the city.

State of the ride-share.

Uber may finally be headed to upstate New York. Yesterday, in his state of the state, governor Andrew Cuomo announced plans to bring ride-hailing to the rest of the state in 2017 (it’s currently allowed only in New York City). Cuomo’s proposal is a big win for Uber, which last year saw its upstate plans derailed by other interests in Albany and knew it could lose again without firm support. The governor has yet to unveil specific legislation, but his preliminary framework for Uber’s upstate operations already contains one notable item: workers’ compensation for drivers. Cuomo would like to see Uber drivers throughout the state pay into the Black Car Fund, an insurance pool that collects 2.5% of each taxi and livery ride in New York City. Uber would likely make this concession; less clear is how the company would respond to additional pressure from labor advocates, such as calls for the Independent Drivers Guild, a pseudo-union of nearly 50,000 Uber drivers in New York City, to be expanded upstate.

Meanwhile, Uber has other problems in the city, where it’s fighting a rule change that would require it and other ride providers to hand over the address and time of each drop-off. (The city already collects this information for pickups.) Uber, in typical fashion, has mass-emailed its riders to drum up support for its position with this foreboding subject line: “The government wants to know where you’re headed … on every ride.” On the one hand, concerning; on the other, Uber already does?

Washio’s tumble.

If you like laundry puns, The Information’s post-mortem on Washio is full of them, beginning with the headline. Washio folded last summer after failing to build a sustainable on-demand laundry business and burning through nearly $20 million. In the end, the startup reportedly scraped together $50,000 by selling all of its assets, from its customer list to its office chairs. Investors and employees got nothing. Washio’s rise and fall is, of course, a warning to all on-demand companies, especially the middlemen striving to provide greater convenience at a lower price. Postmates has raised $280 million to make on-demand deliveries cheap, but it no longer expects a profit until 2018 and has angered customers with high fees and misleading price estimates. Uber and Lyft have kept their fares low through expensive, loss-leading subsidies. Creating true costs savings turns out to be more difficult than connecting customers and service providers through a smartphone. Washio won’t be the last on-demand startup that gets hung out to dry.

Other stuff.

What Uber Can Learn From the Amish About Innovation. China’s Mobike raises $215 million. Alphabet’s Waymo slashes costs of LiDAR sensors by 90%. Uber fares soar 50% in Delhi. Uber to cut fares in 80 North American cities. Uber opens up its data. Didi and Uber face off in Latin America. Lyft hits 52.6 million rides in Q4. Restaurant-booking app Resy raises $13 million, led by Airbnb. Sprig sweetens deal for delivery workers. Money-bleeding Flipkart pays great salaries. Nashville weighs drastic moratorium on Airbnb. Man Claims Uber Driver “Left Him in a Pool of Blood” After Refusing Trip. Swiss insurance agency finds Uber driver is employee. Theranos lays off 150. Uber for Veterinarians. Amazon and self-driving trucks. Trampled by unicorn economics. Your Average CAC Is Lying to You. The Original Sharing Economy. “San Franciscans are not guinea pigs and our public streets aren’t experimental test labs.”