Travis 2.0.

Travis Kalanick is taking an indefinite leave of absence. “For Uber 2.0 to succeed there is nothing more important than dedicating my time to building out the leadership team,” he wrote in an email to staff last Tuesday (June 13), the same day that Eric Holder’s recommendations to Uber were made public. “But if we are going to work on Uber 2.0, I also need to work on Travis 2.0 to become the leader that this company needs and you deserve.”

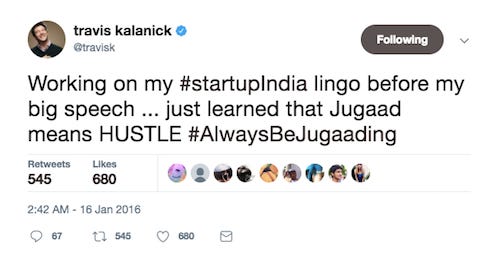

Travis 2.0! It is fun to think of ourselves as having versions that can be patched and redeployed, like an operating system. Travis 1.0 was the smartest bro in the room. He worked hard and played harder and was always hustlin’, even when that wasn’t such a good idea. I assume Travis 2.0 is thoughtful, honest, measured, and poised. He believes in diversity, respects women, and is sensitive to the concerns of each and every driver on the Uber platform. Here, see if you can tell them apart:

That was an easy one, hustle is a dead giveaway. Travis 1.0.

Don’t be deceived by the philosophical underpinnings; disobedience is all Travis 1.0.

Yeah that would be Travis 1.0.

A very Travis 2.0 thing to say! Too bad Travis 1.0 didn’t heed his advice.

Alas Travis 1.0, you spoke too soon.

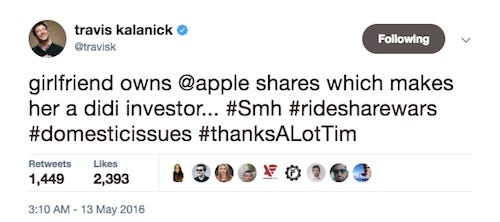

Travis 1.0, #Smh.

A real stumper! Travis 1.0 or Travis 2.0? Vote to oversharingstuff@gmail.com.

War and peace.

While all versions of Travis are on leave, Uber has a lot to think about. It can think about the recommendations in the 13-page Holder report, which range from unsurprising (“reformulate Uber’s 14 cultural values”) to specific (“Uber should consider limiting the budget available to managers for alcohol purchases”) to I-can’t-believe-that-needed-to-be-made-explicit (“devote adequate staff and resources to human resources”).

It can think about the little stuff, like that employees were asked to hug it out at the all-hands meeting, the “war room” is being renamed the “peace room,” and dinner will no longer be served at 8:15pm.

It can think about David Bonderman, a founder at private equity firm TPG, who resigned from Uber’s board hours after making a sexist remark at a meeting about sexism:

ARIANNA HUFFINGTON: There's a lot of data that shows when there's one woman on the board, it's much more likely that there will be a second woman on the board.

BONDERMAN: Actually, what it shows is that it's much more likely to be more talking.

It can think about the other “brilliant jerks” who have left or been dismissed in recent months, such that the top of Uber’s org chart now looks like a slice of swiss cheese. Emil Michael, Amit Singhal, Anthony Levandowski, to name a few. There is still no chief operating officer, a theoretical no. 2 for Kalanick, or chief marketing officer, a role that will supposedly combine the duties of former ride-sharing president Jeff Jones and SVP of global operations Ryan Graves. There is no chief financial officer (though let’s be honest, an IPO must be far from Uber’s mind right now) or SVP of engineering. With Kalanick on leave, there is also, for the moment, no CEO.

Uber can think about the Waymo lawsuit, which has continued apace during its corporate tumult; the federal probe into its “greyball” software to deceive law enforcement; the rape victim in India whose medical records were obtained by a former Uber executive, and who is now suing the company; the three Uber drivers who were deemed employees by New York state for jobless payments, in a continuing threat to the business model; Susan Fowler, the former engineer who catalyzed everything with her blog post, who says Uber has yet to apologize and that its recent contriteness is “all optics.”

Maybe Uber never apologized to Fowler, but it did tell riders it was ready to “embrace radical change” in an email blast on Friday (June 16). Because at the end of the day, those riders are the people that Uber really needs to think about, regardless of ethics or optics or anything else. You can believe or not believe that Uber wants to reform its culture depending on your level of cynicism, but you should absolutely believe that Uber wants to win, and its de facto leadership in ride-hailing has been threatened by all the events of this year. People are still taking Uber, but they are also riding more with Lyft. Uber really, really needs to think about that.

Groceries.

Like many people, I was looking forward to having a quiet Friday last week, maybe tying off some loose story threads and cleaning out my email inbox, so it is only logical that at or around 9am ET Amazon said it was buying Whole Foods.

As someone on the internet probably told you, this is a big deal! It was only two years ago that Whole Foods CEO John Mackey predicted grocery would be “Amazon’s Waterloo.” Now the same guy is head over heels for Amazon, as he told employees: “It’s been a whirlwind courtship” (six weeks!); “This is not a Tinder relationship;” “It was truly love at first sight.”

Jeff Bezos has been after grocery for a long time. AmazonFresh debuted in 2007 on Mercer Island, a suburb of Seattle. Amazon spent six years tweaking the model (it tried a free loyalty program called “Big Radish”) before expanding to Los Angeles and San Francisco in 2013. But here we are in 2017 and Fresh, unlike Amazon Prime, has yet to become a household name.

Webvan, one of the most spectacular flameouts of the first dot-com bubble, made a bad name for grocery e-tailers. But don’t be deceived: Online grocery is the holy grail of retail. Groceries are one of the few things that most people buy routinely, and companies from Amazon to Walmart and Target believe that a reliable grocery offering is the key to attracting more customers, and turning their existing ones into better, more loyal shoppers.

What does Amazon get with Whole Foods? Branding, consumer loyalty, and hundreds of upscale distribution centers:

The global logistics system is really fantastic at moving immense amounts of goods over long distances to and from distribution points around the world: We can load up a ship with a huge number of containers, transfer them efficiently to trucks and railroads, and store their contents at high-tech distribution centers. But it’s that last mile—bridging that final small distance from distribution hubs to individual customers—that’s a challenge. Especially to those in the business of delivering fresh goods, which can’t simply be left to rot on customers’ doorsteps while they’re at work.

But what physical stores have always done is to make the store the last mile. With brick and mortar, it is the customer who invests the time and energy to travel the to the store—or the mall, or the strip mall, or the big-box retailer—to pick up the goods and deliver them to his or her own home… So imagine the possibilities. You, an Amazon Prime customer, can shop for groceries at Whole Foods on Amazon and then choose an option to pick up the groceries on the way home. (Maybe there’s even a discount for doing so.) And, of course, you might then be offered the option to order a bunch of other stuff on Amazon (a couple books, some socks, garden tools) and choose to pick those things up at Whole Foods at your convenience.

That is from the great Daniel Gross at Slate (my former employer). He’s right, of course. “First” and “last” mile delivery is notoriously tricky, which is one reason why startups like Instacart and Postmates—tech-savvy middlemen—believe they can create billion-dollar companies by delivering goods that last stretch from a storefront to a customer. And what about Instacart, the grocery-delivery startup that inked a five-year deal with Whole Foods and took a small investment from it in February 2016? Instacart has tried to position itself as the best friend of the American grocer, which means it can’t afford to be perceived as allied with Amazon. The company seems to have reached that conclusion by Friday night, when it released a statement saying that Amazon had “just declared war on every supermarket and corner store in America.”

Last but not least, what will happen to poor Blue Apron, which just kicked off the roadshow for its food delivery IPO? For starters, it updated the “risk factors” in its S-1 on June 19 to include this line:

In addition, business combinations and consolidation in and across the industries in which we compete could further increase the competition we face and result in competitors with significantly greater resources and customer bases than us.

The great convergence.

Airbnb is becoming more like a hotel:

Travelers accustomed to hotels have come to expect that they can automatically book an Airbnb without having to ask first for the owner’s permission — something that has long been a fixture of the hotel booking process. They want to know that their reservation is firm. They expect fresh linens and privacy. They also anticipate that hosts will act like hotel staff members, meaning they will be courteous and blend into the background.

Airbnb cannot force homeowners who use its site to adopt its tools and policies; they are not full-time employees. But interviews with more than two dozen hosts showed that many felt pressured to comply. The lesson, Ms. Bishop said, is that Airbnb wants her spare bedroom to be more like a Hilton or a Hyatt, and for her to act like a mini-hotelier.

Privacy and fresh linens are reasonable things to expect, especially when the platform facilitating your service is no longer a startup handing out boxes of “Obama O’s” but the world’s fourth-most valuable private technology company, valued at $30 billion. At the same time, hotels also want to be more like Airbnb! AccorHotels last year acquired OneFineStay and has also taken a stake in home-sharing service Oasis. Marriott and Hilton are moving away from stay-in amenities like room-service and adding bright, spacious communal areas, on the notion that their guests might actually want to talk to each other. Give it some time and maybe the hotels and the home-sharing platforms will morph into one indistinguishable business concept. Goodness knows the aesthetic already has.

Other stuff.

WeWork says it generates $1 billion a year in revenue. Lyft reaches $350 million in tips to drivers. Ola says Ola Share grew 500% in last year. Airbnb buys background-check startup Trooly. Careem raises $500 million. Mobike raises $600 million to expand worldwide. Freshly raises $77 million led by Nestle. Amazon’s Acquisition of Whole Foods Is the Game Changer. Delivery Hero to Use IPO Proceeds to Stay Ahead of Uber. Trump’s Cuba restrictions a blow to Airbnb. Book a 13th-century ruin on Airbnb. Bay Area Airbnb hosts sign up to welcome refugees. Toronto moves forward with rules for Airbnb. Lyft aims for 100% renewable energy. Uber tries to drag Lyft into Waymo lawsuit. Lyft and Uber are 20% of miles driven in SF. Ohio Drunk Drivers Ordered to Install Uber or Lyft. Taxify woos Uber drivers with smaller commission. Uber driver fined in Miami for not speaking English. Uber’s scandals weigh on recruiting. Freada Kapor Klein is now rooting for Uber. Airbnb CMO Jonathan Mildenhall talks diversity. ClassPass adds financing in a down round. “This is going to be the sleeper winner of the on-demand economy.”