Postmates misleads its customers on pricing, Lyft rebuffs GM, and “magical trips” on Airbnb

XXIII

Kozmo 2.0.

Here’s a story I’d been working on for a bit that published Monday (Aug. 16): Postmates has failed to make Uber-for-anything cheap, and is quietly misleading customers about it. On-demand delivery companies like Postmates are riddled with deceptive pricing. They hide fees, mark up costs, impose surprise minimums, and, in Postmates’ case, give “estimated” subtotals that can have little to no bearing on the final charge. Case in point is Shawn Cook, a 20-something mobile game developer in Los Angeles who spoke to me for this story, and whose estimated $48.96 Walgreens order from Postmates wound up costing $94.24. (There was more on him in an earlier draft, but as my editor wisely said, LESS ON THE PLIGHT OF MR. COOK, PLEASE.)

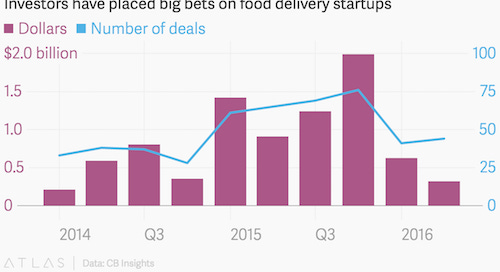

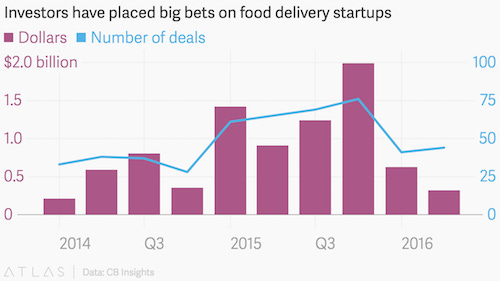

Misleading prices are perhaps the best indication that the Uber-for-X model embraced by Postmates and similar apps (DoorDash, Caviar, Instacart, etc.) doesn’t actually work. These startups won funding and enthusiasm from investors by promising to make on-demand-anything affordable, succeeding where Kozmo failed in the first dot-com bubble. They’ve since learned that the price of instant gratification is rarely cheap. Meanwhile, funding to on-demand food delivery companies is drying up, making it tougher for them to maintain the subsidies that drove growth and kept prices artificially low.

It’s not just Silicon Valley. Here’s a similar piece from Bloomberg, also published Monday, that looks at the implications of a subsidy drop-off for startups in China:

Startups backed by Baidu Inc., Alibaba Group Holding Ltd. and Tencent Holdings Ltd. once offered plentiful and steep discounts on everything from on-demand massages to personal trainers in a massive land grab. But as consolidation revs up—seen most recently in Didi Chuxing’s acquisition of Uber Technologies Inc.’s Chinese operations—this peculiar golden era for smartphone-wielding consumers is waning.

Companies like Postmates bet that they could reel customers in with cheap subsidies, then get them hooked enough on convenience to tolerate an increase in prices. It’s unclear whether that’s actually the case. Postmates isn’t Uber. It’s not exploiting a regulatory loophole or “disrupting” an overpriced establishment industry to unlock greater pricing efficiency. At its core, Postmates is a middleman, employing some people to bring stuff to other people. The service is neither new nor revolutionary. When the free money disappears, what’s to keep customers coming back?

Ride-hailing suitors.

“General Motors in recent weeks told Lyft it was interested in acquiring the company,” reports Amir Efrati at the Information (paywall). “After soliciting other potential strategic acquirers, Lyft rebuffed GM’s approach and decided to raise a new funding round instead”:

GM mentioned a price it was willing to pay but that amount couldn’t be learned, and it’s unclear who initiated the conversation. GM paid $500 million for a 9% stake in Lyft at the start of the year, valuing the company at $5.5 billion. GM’s president sits on Lyft’s board of directors. The bid signals GM’s seriousness about increasing its investment in ride-sharing, as Lyft would likely require billions of dollars in further investment. Lyft trails Uber by a wide margin overall in terms of market share in the U.S.

I think it’s fair to say that Lyft’s future in the US is uncertain. The outlook probably depends on whether you think ride-hailing is winner-takes-all or winner-takes-most, with room for a no. 2 player like Lyft. Either way, it’s not great. Uber’s recent sale of its China business to Didi Chuxing—and $1 billion investment from Didi—destabilized the supposed “global ride-hailing alliance” that Lyft and a few other firms had formed against Uber. The Uber-Didi deal also lifted a $1 billion-a-year burden from Uber’s balance sheet, freeing it up to focus on other battles, like the one against Lyft in the US. Anecdotally, it certainly seems like Uber has intensified its promotions in the last week or so. Everyone I know seems to have at least 50% off their next X-number of Uber rides. For Lyft to keep competing, it will undoubtedly need a fresh source of funds, whether that comes via investors or a buyout. See previous discussion of startup subsidy wars.

Wage theft.

Alex Rosenblat, a researcher who studies the sharing economy, is interested in how it might lead to wage theft. Here are two of the more interesting examples she considers, both on Uber (my paraphrasing):

Uber allows drivers to cancel a ride and charge a cancellation fee after five minutes. But in its driver contract, Uber recommends they wait at least 10 minutes. Uber also doesn’t provide a countdown clock in the app so that drivers can see when their waiting period has elapsed. And many drivers complain that after they request a cancellation fee, it isn’t paid out. Is this wage theft?

Uber sometimes selects drivers to earn guaranteed hourly wages but doesn’t explain why. These drivers earn their guarantees by working at specific times and accepting the majority of their ride requests. But Uber doesn’t offer any analytics to help drivers monitor whether they are meeting criteria to qualify for the guarantee. Does this information asymmetry disadvantage drivers? Do Uber’s guarantees create a system of “tiered wages”?

Elsewhere: Uberisation and the Dangers of Neo-Serfdom.

“Magical Trips.”

Airbnb is planning to introduce a “Magical Trips” program in November that will let hosts make additional money by “recommending restaurants or giving tours around neighborhoods for their visitors and even for locals,” according to this article in the Information (also paywalled, sorry). “Longer term, Airbnb is mulling ways to get home-builders to plan houses and condos with extra rooms for short-term stays.” There are plenty of real things to parse here, like Airbnb’s apparent desire to offer pseudo-concierge services as well as its pivot toward urban planning (see also: project Samara). But honestly let’s just talk about the name. Magical Trips?! Will they take place near an enchanted forest? Will there be unicorns? How many unicorns? Flying Ubers? Is this name deliberately ironic or really do people just think this way in Silicon Valley?

Other stuff.

Brazil’s iFood raises $30 million. Used-car startup Carvana nabs $160 million. WeWork Misses Mark on Some Lofty Targets. How Hyperloop One Went Off the Rails. Tech IPO Clog Poised to Burst. University of Michigan partners with Toyota Research Institute. Uber files complaint with EU against Hungary. Airbnb makes it harder for hotels to price gouge. Interview with Airbnb’s Joe Gebbia. Uber-for-X native content. Small victory for ride-hailing union law in Seattle. Jet.com deal is a win for its investors. Uber scraps UberT. Yellow cabs are undercapitalized. Uber Driver to Watch Son at Olympics, Thanks to Passenger. What Beijingers think of Uber and Didi. Rahm Emanuel’s former chief of staff joins Uber. “Logan’s Life Plan.” Silicon Valley’s Most Self-Destructive Founder. “His leadership style is also cut-throat and tinged with nationalism.”