Illegal hotels.

The New York State Senate on Friday passed a bill that would make it illegal to advertise short-term home rentals online (i.e., those lasting less than 30 days). The bill is written broadly but clearly targets Airbnb. It fine hosts up to $1,000, $5,000, and $7,500 for their first, second, and third violations, respectively. Needless to say, the tech community is up in arms. “It’s disappointing—but not surprising—to see politicians in Albany cut a last-minute deal with the hotel industry that will put 30,000 New Yorkers at greater risk of bankruptcy, eviction, or foreclosure,” says Josh Meltzer, Airbnb’s New York head of public policy. And here is Paul Graham, of Y-Combinator fame:

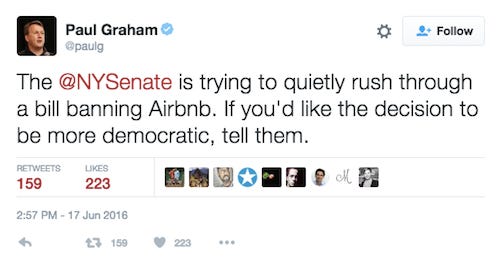

What the tech community is conveniently leaving out of this story is that Airbnb was essentially already banned in New York. Per state law, it is illegal to to rent out entire units in apartments for less than 30 consecutive days, something that makes up the vast majority of activity on Airbnb. In 2014, the state attorney general released a report finding that 72% of Airbnb rentals in New York City were violating the law. The AG also found that, contrary to Airbnb’s favored saying about its service giving an economic lifeline to middle-class Americans, the 6% “commercial” hosts with three-plus property listings were doing 36% of short-term bookings and collecting 37% of all host revenue.

In the nearly two years that have elapsed since that report came out, the city and state have done little to curb Airbnb’s presence, in large part because they don’t know how. The problem with trying to find and penalize Airbnb hosts who are illegally renting their apartments (and, for the record, officials are much more concerned about the “commercial” operators than your neighbor Airbnb’ing his unit for one week in January) is that regulators need to know who those hosts are, and Airbnb has repeatedly refused to hand over the data. That seems like the point of this new bill. If Airbnb won’t tell the state which hosts are breaking the law, then the state will just make it illegal to advertise rentals that break the law. Which is what it’s doing.

Elsewhere: City Mayors Worldwide Forge Alliance in Response to Airbnb, Uber.

Please fund.

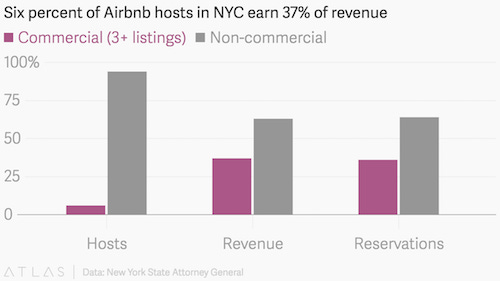

It seems like hardly a week goes by without some mega-fundraising news from Uber, and the last one was no exception. Uber is reportedly seeking as much as $2 billion in the leveraged-loan market, with a target yield of 4-4.5%. Meanwhile, its China rival Didi Chuxing, not to be outdone, wrapped up $7 billion in funding ($4.5 billion in a round that included a $1 billion investment from Apple, and then a $2.5 billion debt package from China Merchants Bank). Uber’s valuation as a global business remains far greater than those of its competitors, but in terms of raw funding numbers Didi is catching up. To date, Uber has raised $11.5 billion according to CB Insights, while Didi has brought in $9.6 billion. And while Uber’s resources are spread thin around the world, Didi’s are dedicated solely to winning China.

Anyway, my favorite take on Uber’s leveraged-loan ambitions came, as it often does, from Matt Levine at Bloomberg View:

My dream for Uber is that it will stay private long enough to become profitable, so profitable that it can replace this year's leveraged loans with just regular old investment-grade bank loans, and run a normal, large public-company capital structure without actually being a public company. Then my real dream for Uber is that someone will look around and say "hey we have too much equity," and mount a leveraged buyout of Uber's stock before the IPO ever happens. It's a bit of a challenge, LBO'ing a private company, but I bet Uber is up for it.

One Kings Lane.

In 2014, One Kings Lane’s $900 million valuation and flash sales of $1,000 cloud bubble chandeliers made it one of the hottest startups in e-commerce. Last week, it was purchased by Bed Bath & Beyond for an undisclosed but “not material” amount. Surprising? Perhaps not. Analysts have been gloomy on flash-sales sites for some time. Gilt Groupe, once valued at over $1 billion, sold in January for $250 million to Hudson’s Bay, the parent company of Saks Fifth Avenue. This past December, One Kings Lane laid off 25% of its staff, its second big round of job cuts in the last 18 months. That said, I am hard-pressed to think of a less glamorous end for a once near-unicorn than what happened to One Kings Lane. Like, if you had told me that the tech gods exacted this as tragicomic comeuppance for an overhyped startup, I would totally have believed you. In the valuation-obsessed world that is Silicon Valley, few things must sting like a “not material” purchase price.

Unicorns fly.

Cloud communications company Twilio last week priced its IPO—100 million shares at $12-$14 apiece—which would make it the first billion-dollar startup to go public this year. The broader drought in tech IPOs ended in April when cybersecurity firm SecureWorks listed on the Nasdaq. Before that, things were Great Recession-level ugly.

Other stuff.

Zenefits cuts more jobs. Instacart tests pickup only. Mega-deals on the horizon for Silicon Valley. Emails Reveal Bitter Silicon Valley Fight. Profitability in a “post-unicorn” era. Office envy from Facebook to Uber. “It was like an IKEA set up but nobody really slept there.” General Assembly raises $7.35 million. Co-living is nothing new in China. Airbnb lands $1 billion debt facility. Rent George Pataki’s mansion for just $20,000. UberEats debuts in London. Charting the war to deliver your food. Meet Uber’s Political Genius. Uber price-fixing lawsuit could go to arbitration. Uber settles on background checks. Should Uber offer unemployment? Uber likes regulations, so long as it also writes them. (See here: Chicago.) Twitter Is Hoping a Magic Pony Will Help It Stay Relevant in Video. “The role of Tronc is to transform journalism, from pixels to Pulitzers.”

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can direct them to sign up here. Header art by Maddie Schuette, who is available for hire. Send tips, comments, and magic ponies to oversharingstuff@gmail.com.