Marc Andreessen goes with the Flow

"Only projects with such lofty goals have a chance at changing the world"

Hello and welcome to Oversharing, a newsletter about the sharing economy. If you’re returning from last time, thanks! If you’re new, nice to have you! If you’re enjoying this newsletter, give it a like 💛, subscriptions might cost money but likes are free for all.

WeFlow.

Having recently been revealed as a closet NIMBY who penned a manifesto on America’s housing shortage while working to crush a multifamily development in their own backyard, a lesser mortal might have been chastened from further commentary on the nation’s housing crisis. Not Marc Andreessen. The billionaire venture capitalist announced Monday in a post on his firm’s blog that a16z has identified the savior of residential real estate as none other than Adam Neumann.

In case you forgot or have been living under a rock (understandably, I hear housing costs are out of control these days), the WeWork founder built a global office-rental empire from spa water, beer on tap, unlocked superpowers, elevated consciousness, community adjustments, and some $9 billion of investor money. He did this while swigging tequila shots, surfing with Laird Hamilton, surfing in the Maldives, and smoking weed on transatlantic flights. When one day it all came crashing down, SoftBank threw WeWork a $10 billion lifeline while Neumann walked away (shoeless, obviously) with a $1 billion exit deal.

Or, as Andreessen tells it:

Adam is a visionary leader who revolutionized the second largest asset class in the world — commercial real estate — by bringing community and brand to an industry in which neither existed before. Adam, and the story of WeWork, have been exhaustively chronicled, analyzed, and fictionalized – sometimes accurately. For all the energy put into covering the story, it’s often under appreciated that only one person has fundamentally redesigned the office experience and led a paradigm-changing global company in the process: Adam Neumann.

The new company is called Flow and it is “coming in 2023.” What exactly Flow will do to change paradigms and build the future of living is unclear, but according to Andreessen the project is “not lacking in vision or ambition.” Presumably this is why a16z cut Flow a $350 million check, its largest ever single investment, at a $1 billion valuation, before it launched anything other than a signup page and a logo. Neumann has reportedly purchased more than 3,000 apartment units in Miami, Fort Lauderdale, Atlanta, and Nashville, and plans to reimagine housing rentals as a branded experience with services and community features.

In his latest post, Andreessen writes that the housing market is broken, stuck in the two models of renting or home ownership. Andreessen, himself a prolific home owner, turns out to be no fan of renting, which he declares a “soulless experience”:

do you even meet your neighbors, much less have any friends in your complex? Does it feel like home, or just a place to sleep? Are you proud to bring friends and family to visit, or hesitant? And you can pay rent for decades and still own zero equity — nothing. There’s a reason the federal government started subsidizing home mortgages: someone who is bought in to where he lives cares more about where he lives. Without this, apartments don’t generate any bond between person and place and without community, no bond between person to person.

People sometimes say that Silicon Valley is too obsessed with ‘saving the world,’ but as I write this from my soulless and friendless apartment, I for one am grateful for firms like a16z. It takes a great deal of courage and bravery to write your biggest check ever to a disgraced founder whom many believe to be a charlatan because you care that deeply about uplifting the lonely masses and solving America’s housing crisis. Some might say this is a deluded fantasy and that $350 million could be better spent on affordable housing, housing justice groups, or a founder who did not previously blow up a multibillion-dollar company. These people lack vision. Our nation has a housing crisis and it requires an Adam Neumann-sized solution. As Andreessen says, “Only projects with such lofty goals have a chance at changing the world.”

Fareflation.

The cost of living crisis is headed for London transport, with mayor Sadiq Khan warning that Londoners could face “unprecedented” increases in Tube and bus fares next year. As part of a funding deal for Transport for London (TfL), the UK government wants fares hiked by inflation plus 1%, which the way things are going could be 13-14%. That would bump the cost of a bus trip from £1.65 to £1.90, and of a single tube fare through central London from £2.50 to £2.85. Costs would also jump for the various prepaid passes TfL offers, like the seven-day travel card, as well as for the daily pay-as-you-go cap on Oyster and contactless payment users.

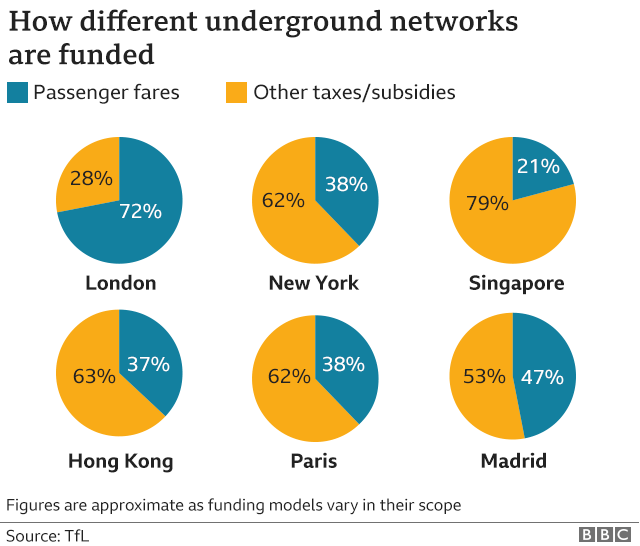

TfL is unique among major metro transit systems for being funded primarily by passenger fares. That also made it uniquely vulnerable to the devastating plunge in transit ridership and fare revenue during the pandemic.

Before covid hit, TfL had steadily reduced its operating deficit and was on track to break even by the 2022-23 year. Now, the agency has been forced to seek multiple government bailouts, the latest of which expired August 3. TfL is exploring £35 million worth of cuts to bus routes, which includes axing six routes entirely, and last month quietly scrapped funding to local councils for cycling training. Khan has repeatedly warned of a “managed decline scenario,” in which funding constraints force cuts to TfL services, which leads to worse quality service and a decline in ridership, which means less fare revenue and further cuts to services, and so on, plunging London transport into the sort of downward spiral that New Yorkers who lived through the subway meltdown know all too well.

All of this is obviously bad for goals like reducing car use, cutting transport-related emissions, and providing affordable and equitable transit service. We can only hope that TfL commissioner and ‘Train Daddy’ Andy Byford, who became a populist hero in New York City for rescuing the subway from rock bottom a few years earlier, can repeat the trick in London.

Elsewhere in London transport, TfL will add e-bikes to its Santander ‘Boris Bikes’ cycle-hire scheme for the first time starting in September. Renting one of the 500 e-bikes will cost £3.30 for 30 minutes, double the rate for a regular bike, which is being cut to £1.65 from £2, making it the same as a bus fare. TfL will also offer a new monthly subscription for £20 that includes unlimited 60-minute rides, and hike the price of an annual membership to £120 from £90 to reflect “increased running costs and inflation since the annual membership price was last changed in 2013.” Subscribers will pay a £1 surcharge on e-bike rides of up to 60 minutes. Santander Cycles boomed in popularity during the pandemic and said 2021 was its best year ever, with more than 1 million riders and nearly 11 million trips.

Bad taste.

Remember meal kits? Here is a story about how many of them aren’t FDA regulated:

Days after trying a new lentil product from the meal subscription company Daily Harvest, Los Angeles resident Jackie Sloboda was debilitated by full-body itching, stabbing abdominal pains and jaundice that turned her skin and eyes yellow.

On her third day in a West L.A. hospital, as she worried that she was dying of liver failure, Sloboda, 36, learned that the product she had eaten twice had just been recalled. Soon, hundreds of people in 36 states would report gastrointestinal pain and abnormal liver function, and 113 would be hospitalized, the highest number of any known U.S. foodborne illness outbreak this year, according to federal data.

The Los Angeles Times reports that of the hundreds of companies that sell and deliver ready-to-heat and -prep meals, very few must register with the FDA or follow rules designed to reduce the spread of foodborne illness, keep shipping conditions sanitary, and maintain supply-chain transparency. Daily Harvest told customers five weeks after the recall that they’d been sickened by tara flour, an ingredient in the lentil crumbles. Meanwhile, another meal kit company, Factor, is recalling almost 150,000 risotto dishes because the arborio rice might contain glass, so maybe just go to the grocery this week and buy stuff yourself.

Other stuff.

The organized labor movement has a new ally: venture capitalists. One dead, nine injured after BMW test car with autonomous steering crashes into oncoming traffic. California bill would give $2,500 tax credit to people who don’t own a car. The Summer of NIMBY in Silicon Valley’s Poshest Town. MTA Eyes Congestion Pricing Toll of Up to $23 Per Vehicle Trip into Manhattan. NYC considers permits for e-bikes and e-scooters on the subway. China’s bike-share survivors try to turn a profit by raising prices. FTC investigation into Prime spreads to four other Amazon subscription services. In Beirut, taxi app Bolt spreads despair in an already devastated economy. Dockless bikes dumped in Westminster to be seized. Bike shops struggling with excess stock, “like a surfer who did not catch the wave.” Meditation App Calm Lays Off 20% of Staff. How Airbnb is ruining local communities in north Wales. What the new USPS overhaul law means for you. Domino’s leaves Italy. The Rise of the Worker Productivity Score. Lollipop arbitrage. Failure to cope under capitalism. Elon’s Biggest Boondoggle.