A friendly reminder that Oversharing has moved to Tuesdays. That was supposed to take effect last week, but TinyLetter’s abuse prevention system apparently wasn’t a fan of the change. It’s all happening now, though. Happy Tuesday.

Signs of the times.

Is the tech bubble bursting? Yes, says the Wall Street Journal, it is, sales of ping pong tables are down. “Last quarter was hot” for tables, says Simon Ng, owner of Billiard Wholesale in San Jose, but now “there’s a general slowdown.” The story contains a chart, “Tech Bounce,” showing how ping-pong table sales at Billiard Wholesale have been loosely correlated with venture capital deals for the last several quarters. Seeing as the whole theory is premised on a sample size of one—Ng’s store—I’m not sure you want to start investing on it right away. That said, ping-pong table sales do seem like a good indicator of who’s cool and who’s not. Google: just bought a bunch. Yahoo: nothing for a “looong time.” Twitter: “we’re more of a Pop-A-Shot company now.”

Elsewhere, Dropbox is starting to cut back, but keeping the five-foot-tall, gleaming chrome panda statue it purchased last month for a rumored $100,000 “as a company-wide reminder of the importance of both our past and future in thoughtful spending.” And venture capitalist Keith Rabois tells Business Insider, “I wouldn’t say the easy money’s gone, but the price of oxygen has increased.”

Storming out.

Uber and Lyft have departed Austin after losing a special election in the Texas capital. Fifty-six percent of voters came out against Proposition 1, upholding ride-hailing regulations passed by Austin’s city council in December. The rules are stricter than what Uber and Lyft face in most other jurisdictions: They require drivers to undergo fingerprint-based background checks, identify their cars with company emblems, and avoid dropping off and picking up passengers in certain lanes. They also impose data reporting requirements on the companies. Uber and Lyft claim these regulations—and particularly fingerprinting—make their services inoperable, though if we’re being honest that’s a bit hyperbolic. Uber has operated in Houston despite fingerprinting requirements for the last year and a half. In New York City, where Uber recently celebrated its fifth birthday with free pizza, the company has established its biggest and most profitable market in the US, fingerprinting rules and all.

Anyway, the defeat in Austin is crushing for Uber and Lyft for two reasons. One, it challenges Uber’s (and to a lesser extent, Lyft’s) image as politically unbeatable. Uber likes to say that it succeeds in changing the rules with local legislatures because even with policymakers stand in its way, riders and drivers mobilize to demand a “new way of dong things.” Austin defies the narrative. Two, Uber and Lyft threw a lot of money at this election, and they still lost. The companies spent a combined $8.7 million via their lobbying committee, Ridesharing Works for Austin, an unprecedented sum in Austin local politics and more than 60 times what the other side collected. Based on the final poll counts, that means Uber and Lyft ultimately paid about $225 for each of the 38,000-odd votes they received. The cost of a fingerprinted background check for a driver, comparatively, is $40, but I guess you can’t put a price on precedent.

Out of demand.

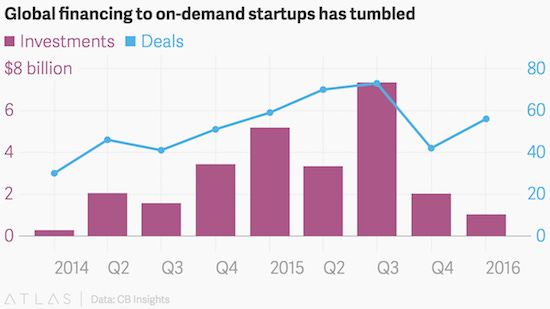

The era of free money is waning, if not over, in Silicon Valley—even in the once red-hot on-demand sector. Global financing to on-demand startups tumbled from a high of $7.3 billion in the third quarter of 2015 to just $1 billion in the first quarter of 2016, according to data from CB Insights. It’s a dramatic plunge for a sector that investors have poured money into for the last two years, largely in hopes of landing the next Uber or Airbnb. Deals have cooled in particular for on-demand startups that work in food and grocery, as well as parking and car rentals. Probably not surprising, when you consider the recent fates of Zirk, Luxe, and Instacart.

Thinking ‘glocal.’

Airbnb is a global business, with more than 34,000 homes and rooms across 190 countries, but also a local one. Joe Zadeh, VP of product, talks to Brian Solomon at Forbes about how the company balances those two things, which he calls the “glocal” challenge. Amazingly enough, this is apparently a term that has been in use for some time, though I think we can agree that the English language would be much better off without it.

Other stuff.

Trump supporters are the real unicorns in Silicon Valley. Peter Thiel is one of them. Uber sets up policy board. Uber grows marketing team. Uber sued over driver classification, again. Self-driving cars, people-driven lobby. Via raises $100 million. Uber revamps Pool. Uber of drones. Self-driving taxis. T-Swift unicorn onesie. BlackJet crashes. Global nomads. Tortilla pods. “We have great reverence for Burning Man, but there’s always an element of arduousness. Here, we have spa treatments and green juice.”

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can direct them to sign up here. Header art by Maddie Schuette, who is available for hire. Send tips, comments, and gleaming chrome pandas to oversharingstuff@gmail.com.