Hello and welcome to Oversharing, a newsletter about the proverbial sharing economy.

If you’re returning from last week, thanks! If you’re new, nice to have you! (Over)share the love and tell your friends to sign up here. This is issue eighty-six, published December 12, 2017.

Silicon Valley's liquidity crisis.

Working at a successful startup is supposed to be a quick path to prosperity, but the reality is more complicated. Most startups offer equity packages to compensate for below-market salaries. As these "unicorn" companies have stayed private longer, a lot of their employees haven’t actually gotten rich. Quite the contrary, at Uber, some former employees have gone into debt to hang onto shares they still can’t sell.

Here's a story I reported recently on two former Uber employees, both of whom left the company in 2016 and had just 30 days to exercise their options. One of those former employees paid about $100,000 to exercise more than 20,000 incentive stock options (ISOs), plus a tax bill of over $200,000. The other paid about $70,000 to exercise about 5,000 ISOs, and then about $160,000 in taxes. Both former employees took out loans from family members to make the payments, and requested anonymity to discuss their personal financial situations.

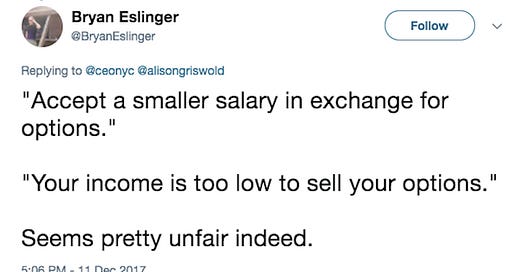

Thirty days is an unusually short exercise window, and earlier this year Uber changed it to seven years. But 90 days, not much longer, is also not so uncommon. These short exercise periods are supposed to help retain talented employees, but instead they can subvert the entire incentive structure, so that the best and most loyal employees feel trapped rather than rewarded. Here is a good tl;dr from a guy on Twitter:

Lean Startup author Eric Ries calls this evidence of a "liquidity crisis involving all of Silicon Valley." Andrea Coombes, a retirement and investing specialist at NerdWallet, dubbed it the "dark underside of the stock option dream." It's also another way that Silicon Valley keeps its wealth concentrated among those already at the top. Not a lot of people's families just have $300,000 sitting around to loan them, and if former startup employees can't come up with that money, they might have to abandon their chance at a payday.

Of course there is also the counterpoint, which is WeWork CEO Adam Neumann. WeWork, like Uber, has amassed a tremendous valuation while staying private, most recently around $20 billion. Like Uber, WeWork's employees are presumably wealthy on paper, less so in real life. But that hasn't kept Neumann from living like a bona fide billionaire. According to the Real Deal, Neumann has purchased four units in a seven-story building at Irving Place, in the swanky New York neighborhood of Gramercy.

Property records show a buyer paid $18 million for a 4,400-square-foot duplex penthouse with four bedrooms, 5.5 bathrooms and a private roof terrace; $9.5 million for a 2,210-square-foot, three-bedroom pad on the fifth floor; and a combined $7.2 million for two units on the first floor.

The purchase reportedly adds to a property list that already included a $15 million estate in Westchester, an $11 million townhouse in the West Village, and a $1.8 million house in the Hamptons, a lot of property for a guy who believes the future is co-living.

"A big step forward."

Airbnb scored a victory in Seattle yesterday (Dec. 11) when the city council passed rules that limit short-term rentals to two units per host. The regulations require Airbnb and other short-term rental hosts to obtain a "platform license" for their bookings and to pay a tax of either $8 or $14 per night, depending on the type of rental. In an additional win for Airbnb, the rules also exempt some existing Airbnb hosts from the two-unit maximum, depending on what part of the city they live in.

The Seattle vote follows a similar one in Toronto last week where the city council approved Airbnb rentals of primary residences for up to 180 days a year. Toronto's rules ban the rental of basement apartments, reportedly affecting about 700 of Airbnb's current 10,000-ish listings in the city. "This is truly a big step forward for the city of Toronto," Alex Dagg, Airbnb's policy director for Canada, said.

That Airbnb is hailing the Seattle and Toronto rule changes as a win is evidence of how much the home-sharing company has changed its approach. Airbnb, founded in 2008, used to flout home-rental regulations aggressively, but in 2016 and 2017, the rules started catching up with it. Faced with that reality and ahead of a potential IPO, Airbnb has spent the last two years cleaning up its act and refashioning itself as a friend of cities, from Seattle to Toronto to Berlin.

The battle isn't over yet. In Paris, for example, the city is threatening to sue Airbnb if it doesn't delist hundreds of apartments whose owners have failed to register with local authorities. Paris as of July was Airbnb's biggest city, with 65,000 homes. Only 11,000 of those have been registered as required, according to AFP. In Singapore, two landlords were recently charged for illegally renting out apartments for short-term stays, and could face fines up to $149,000.

Meanwhile, a new study from McGill University finds that "many neighborhoods—above all in Montreal—have seen two or three percent of their entire housing stock converted to de facto hotels," a worrying note for Airbnb, which is working hard to convince cities that its rentals don't take away from permanent residential housing. In response, Airbnb condemned the study's author, David Wachsmuth, as having "a history of manipulating scraped data to misrepresent Airbnb hosts." So, you know, there is some work to do yet.

Food delivery unicorns.

I am beginning to think the true unicorn is not any tech startup but SoftBank's Vision Fund, which has seemingly infinite billions to throw at Silicon Valley's sexiest companies. I think the metaphor works. Unicorns, per mythology, have the power to heal, and you could argue that SoftBank's vision fund is providing life support to some flashy but desperately ill startups.

In its latest move, SoftBank is reportedly contemplating a $300 million investmentinto DoorDash, the San Francisco-based food delivery company:

While the DoorDash deal has not yet closed and could still fall apart, the sources added, the total investment is expected to be about $300 million, if it is completed. The exact terms of the deal couldn’t be learned.

The food delivery company was last valued at around $720 million in March 2016, according to PitchBook, which includes the $130 million it has raised.

One question is whether a SoftBank investment into DoorDash would conflict with its multibillion-dollar tender offer for a stake in Uber, which operates competing food delivery service UberEats. (According to Recode's sources, that is a concern that could impede the deal.) Here is a slightly outdated chart of VC funding to food delivery startups, which fell off a cliff in 2016:

Elsewhere in food delivery, Postmates has partnered with Philadelphia-based "farm-to-table marketplace" WeGardn to do grocery delivery, a service Postmates unveiled last month. Aside from my general and I think merited skepticism of Postmates, I remain bemused by the company's promise to guarantee 30-minute grocery delivery as a matter of pure logistics. Which is to say: If I were your private grocery shopper, and I were already at the grocery when you called me with an order, I am still not sure I could find everything, check out, and deliver it to your house in less than 30 minutes. Time and space are often an inconvenient reality: you can get stuck on the subway for 45 minutes; you can't go faster than the speed of light. Or, you know, you could promise 30-minute grocery delivery and then actually have to make good on it.

Career drive.

Here is a story about how Lyft, in an effort to court drivers, is offering them discounted access to online GED and college courses, through a partnership with Denver-based Guild Education. Discounts will range from 5% to 20%, on average around $4,200 a year. Lyft wouldn't disclose how much the program cost, but said internal surveys show drivers want to earn degrees.

As with any job, the benefits that the company offers are designed to encourage the workers to stay longer at the company. Retention is notoriously poor in the gig economy and particularly the ride-hailing business, and so, naturally, it's a factor in Lyft's new educational offerings. To qualify for the program, Lyft drivers must have done 10 rides in the current or previous quarter, and then continue doing at least 10 rides a month.

Shanae Watkins, a driver based in Baltimore, would like to become a social worker. She is currently working on her bachelor's in psychology through online classes. "It's better that way with my kids," she says. "I can drive or study while still being present at home when they need me."

Watkins drives for Uber, Lyft, GrubHub and Amazon Flex and, she says, she does not have loyalty to any specific gig company.

"I turn on the apps and see where the demand is," she says. But, she says, if one of them offered help with the cost of school, that could move her to shift her loyalties.

Uber, to my knowledge, doesn't have a comparable program, but it has piloted a small initiative to subsidize education for drivers in Pittsburgh. According to local news outlet The Incline, Uber said in early December (i.e., before the Lyft announcement) that it would give out $500 each to 100 drivers over the spring and summer 2018 semesters, to be used for tuition, fees, book, or classes at the Community College of Allegheny County. To qualify for that program, drivers need at least 300 trips, and one trip in the last 30 days.

The $50,000 commitment is reportedly the result of talks between Uber and Pittsburgh mayor Bill Peduto over the summer, where Peduto raised "partnering with community colleges to provide career development classes for drivers." Uber was presumably interested in smoothing things over with the city, after being called out earlier this year for not "offering anything back to the public."

Other stuff.

Silicon Valley Is Sneaking Models Into This Year's Holiday Parties. Hillary Clinton campaign was warned against Shervin Pishevar. Justin Caldbeck sends same "sorry" email to harassment critics. Zero tolerance for sexual misconduct in venture capital. Airbnb Rentals Are Being Turned into Pop-Up Brothels. Taxify launches in Australia. Rob Rhineheart out as Soylent CEO. Uber's credit card is bankrupting restaurants. Uber cuts deal with Singaporean taxi operator. Didi Chuxing eyes Mexico. Ofo raises $1 billion. LimeBike hits 1 million rides. Russia's largest phone carrier takes on Uber. The last generation of long-distance truckers. Lyft driverless pilot with nuTonomy launches in Boston. It's complicated between GM and Lyft. Furious shoppers think Amazon is ruining Whole Foods. Latin American food-delivery company raises $82 million. BuzzFeed partners with Walmart to sell Tasty recipes. Rico Logistics buys Jinn assets. Delivery robots need permits in San Francisco. Lyft expands medical transport. Uber to appeal London ban in 2018. Uber settles lawsuit with rape victim in India. Lidar startup Ouster raises $27 million. Saudi Aramco sees ride-sharing as threat to oil demand. Robots aren't killing jobs fast enough. Uber for coffee shops. WeWork for food. All the Christmas Cookie Recipes You'll Ever Need.

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can suggest they sign up here. Send tips, comments, and additional liquidity crises to oversharingstuff@gmail.com.