Hello and welcome to Oversharing, a newsletter about the proverbial sharing economy.

If you're returning from last week, thanks! If you're new, nice to have you! (Over)share the love and tell your friends to sign up here. This is issue 102, published May 1, 2018.

$470,000.

One of the most impressive startup downfalls to witness in recent years has been Blue Apron. While many on-demand startups have quietly sold or shuttered operations—you may recall our in memorium list—few have suffered as publicly and quantifiably as Blue Apron. In the 10 months since the meal-kit company debuted on the New York stock exchange, its stock price has fallen about 80% to pennies above $2. Wall Street is evidently less bullish than Silicon Valley on Blue Apron's "powerful and emotional brand connection" and "hard-to-replicate value chain." Valued by private investors at $2 billion, Blue Apron's market capitalization is now just $400 million.

A good question to ask when a startup stumbles is, who gets hurt? Often the answer is workers. When internet delivery service Kozmo collapsed in 2001, it stopped operating immediately and fired 1,100 people. Many of the on-demand startups that folded over the last five years left legions of contractors abruptly out of work. Occasionally some people are picked up and moved over to a new company that buys the scraps of the failed one, but these deals are usually reserved for senior leadership and talent, not for run-of-the-mill employees. When food delivery startup Maple sold for parts to Deliveroo, for example, the UK-based company wanted Maple's senior leadership, but not its New York-based hourly labor force. If Uber pauses service in any market, the first people to feel the impact are its drivers.

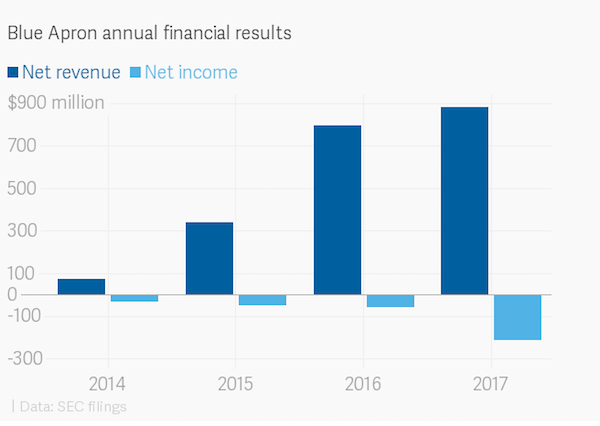

All is certainly not well at Blue Apron. Revenue grew 11% from 2016 to 2017, but losses nearly quadrupled to $210 million. Per the 10-K it filed in February, Blue Apron is no longer building a new warehousing facility in Fairfield, California, and is "continuing to evaluate alternatives" for the lease it assumed in December 2017. The original heart-warming vision of selling farm-fresh vegetables in pre-portioned packages to American families has withered into a mess of losses and lease obligations.

Who is hurting at Blue Apron? Shareholders, who filed multiple lawsuits after the company's lackluster IPO, and whose shares have only lost value since. Staff, who have been laid off by the hundreds. Other employees, who presumably received stock options in their equity packages and are now probably stuck with a lot of out-of-the-money assets. You know who's not feeling too bad, though? Blue Apron's co-founder! Matt Salzberg was replaced as CEO in November and made "executive chairman," and the change came with a big raise. His annual base salary increased to $470,000 from $300,000, a 57% jump, as of Dec. 1, 2017, Blue Apron disclosed last week in its proxy statement. Blue Apron says it uses base salaries "to recognize the experience, skills, knowledge, and responsibilities required of all our employees, including our named executive officers." Three other executives, meanwhile, received bonuses of $100,500, $83,750, and $83,750, "based on their respective bonus targets and the achievement of both individual and company goals."

There is a good bit of research to suggest that retaining a former CEO as a board chair is a bad idea. But even setting that aside, it's unclear what skills and knowledge Salzberg demonstrated, or additional duties he acquired in the transition, to justify a 57% raise. It's similarly unclear what "individual and company goals" Blue Apron's senior executives achieved in 2017 to earn their hefty bonuses even as losses soared and the stock price tanked. It would be interesting to know what the suing shareholders and 300 laid off employees make of it. Those performance results don't really say "bonus!" and "raise!" to me but then again I am not a tech bro. The lesson for startup founders seems to be that unless you go full Theranos, the personal repercussions for building an overvalued and financially unstable company that causes a lot of collateral damage to shareholders and employees can, at the end of the day, be pretty minimal.

EBLWAEAM.

Elsewhere in startup financial schemes, WeWork raised $700 million in a bond offering that featured some highly unusual accounting:

In a document presented to bond investors, WeWork offered some unusual measures of its earnings before interest, taxes, depreciation and amortization last year. While its adjusted Ebitda was negative $193.3 million, its “adjusted Ebitda before growth investments” was $49.4 million and its “community adjusted Ebitda,” which excludes general and administrative expenses, was $233.1 million.

"It shows the economics of our buildings," said a WeWork spokesperson. "In other words, if we stopped growth investments, we have a very healthy business running healthy margins. For bond investors, community-adjusted Ebitda is a number they can hold onto."

Here are my colleagues at Quartz on other suggested accounting schemes for startups and their investors to hold onto:

EER Earnings excluding reality

EEG Earnings excluding gluten

ELOL Earnings leaving out losses

EBAIS Earnings before AI singularity

EBAAI Earnings before Amazon ate our industry

EBPB Earnings before pivot to blockchain

EMFEBT Earnings from moving fast excluding broken things

EBLWAEAM Earnings but like what are earnings anyway, man

Anthony Levandowski.

Remember that time Alphabet subsidiary Waymo sued Uber for allegedly stealing its self-driving car technology, and then they went to court over it, and then they eventually settled? Yes well the case is not quite closed yet:

Uber Technologies Inc.’s settlement of Waymo’s trade-secrets lawsuit in February left a key piece unresolved: the role played by Anthony Levandowski, the engineer at the center of the alleged theft of critical self-driving technology.

Starting Monday, Levandowski goes to trial to defend himself -- and at least $120 million in incentive payments he collected from the search giant before he defected to Uber. He’s fighting Google’s claims that he breached his contract as one of the leaders of its autonomous vehicle unit, now called Waymo, by recruiting from its ranks for his rival company, Otto.

The case is in private arbitration, behind closed doors and out of the public eye. It has quietly drawn Uber back into a fight, if indirectly, that the company eagerly put behind it. That’s because as part of its deal to acquire Otto, Uber agreed to provide Levandowski legal cover, known as indemnification, for claims brought against him by Google.

Waymo may have sued Uber, but the trial in February was a referendum on Travis Kalanick and Levandowski. We were treated to emails and texts that Kalanick and Levandowski exchanged, as well as a video clip of Michael Douglas's "Greed is Good" speech. We learned that Kalanick wanted a "pound of flesh" and Levandowski couldn't spell "lose." If the evidence against Uber was never fully there, the allegations and forensic findings on Levandowski and his theft of 14,000 files looked pretty bad. But Waymo sued Uber, not Levandowski, and the trial was settled before he even got called to testify.

Per Bloomberg, Google's arbitration claim against its former star engineer isn't about technology, but rather that Levandowski secretly used "confidential information regarding the unique skills, experiences and compensation packages" at Google to lure employees to his driverless trucking startup, Otto. Alphabet worried about losing Levandowski before he officially resigned, a concern that ran all the way up the ranks.

"Larry was talking to me about Anthony and wondering what the chances are that we lose him," Google "moonshots" chief Astro Teller wrote to Waymo CEO John Krafcik in November 2015, according to correspondence made public during the trial. (Larry is Alphabet CEO Larry Page). "I think Larry is just worried about helping the competition."

"Competition has been pretty ridiculous esp. since Uber started playing in this space," Waymo's Dmitri Dolgov wrote to Krafcik in January 2016, in another email made public during the trial. "And unfortunately, the skill set of people who work on the onboard stuff is very specialized with a pretty small talent pool, so things will get even more cut-throat."

As of April, all of Otto's co-founders—and all of whom came from Google—had left Uber.

Death knell for parking fees.

One of the promises of self-driving cars is that they will reduce the number of cars clogging up our roads and streets, because more people will share a smaller number of vehicles. People like to talk about how we will use this new space. We will plant more trees, create more bike lanes, and generally have more green spaces for residents to enjoy. But local governments see a dark side to this green utopia: What will happen to parking fees?

Fleets of shared, on-demand, self-driving cars could be the death knell for parking fees, and that’s forcing cities, airports, and the municipal bond industry to devise new ways to extract revenue before it’s too late.

Of course, it won't even take fully autonomous vehicles for this to happen. "You're starting to see less and less parking taking place because people can take Uber and Lyft," Brooks Rainwater, director of the National League of Cities' center for city solutions and applied research, told Bloomberg. "I would expect to see these problems become more acute as time goes by."

In Chandler, Arizona, a testing ground for many driverless car companies, the city is already planning around the self-driving future:

The city will break ground on a parking garage in the fall that will be built with a self-driving future in mind. The garage will have a ground floor tall enough to convert into retail and water and electrical infrastructure to convert additional floors to multi-family housing one day.

Chandler has also drafted new city planning codes that provide flexibility for building parking. They are encouraging developers to reconsider the number of parking spaces, and instead examine if it’s better to prioritize curb space for drop-offs and deliveries.

Other stuff.

Didi in talks with Volkswagen for joint ride-hailing venture in China. CNN investigation finds 103 Uber drivers accused of sexual abuse or assault. Women who say they were assaulted by Uber drivers want out of arbitration. Uber tightens bug bounty policies. Uber's latest diversity report is still not great. Black lawmakers visit Silicon Valley to press on diversity. Taxi driver's family blames Uber for his suicide. New York City may try again to cap Uber's growth. Uber suspends operations in Vienna on temporary court injunction. Lyft chips away at Uber. Kidbox raises $15.3 million for personalized children's clothing. France's Blablacar acquires carpool startup Less. Airbnb Hires Michelle Obama's Former Right-Hand. Amazon raises the price of Prime. Chipotle partners with DoorDash. California deals blow to the gig economy. How to Live in San Francisco Without Spending Any Money. Tesla Doesn't Burn Fuel, It Burns Cash. "The next big name in self-driving vehicles could be the Pentagon." Can You Guess the Airbnb Price With Only Two Pictures?

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can suggest they sign up here. Send tips, comments, and creative accounting schemes to oversharingstuff@gmail.com.