Hello and welcome to Oversharing, a newsletter about the proverbial sharing economy. This is a subscriber-only post. To get the full post and more in-depth analyses of mobility and the gig economy, become a paying subscriber.

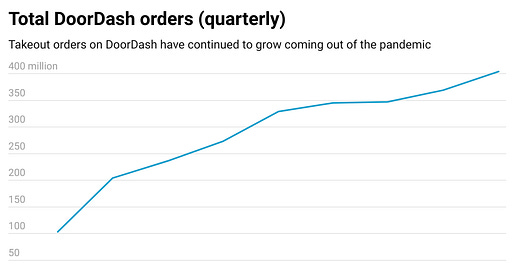

Food delivery companies were among the big winners of the pandemic, for obvious reasons: people were stuck at home, and they only had so many options. They could cook or they could get takeout from a restaurant. A lot of people got takeout. From the first quarter of 2020 to the first of 2021, order value more than tripled on DoorDash and surged 166% on Uber Eats. Order value continued to grow on both platforms during 2021 and hit all-time highs in the first quarter of 2022.

The big question now is whether that growth will stick as many people go back to eating in restaurants. DoorDash CEO Tony Xu thinks it will, which is a good thing to think if you run a food delivery company.

“Dining-in is very complementary to actually ordering delivery,” Xu said on the company’s first quarter earnings call earlier this month. “I mean, when you’re dining in, you’re looking for that experience to maybe see people you haven’t seen in a while in person, and that’s very complementary to ordering delivery because, again, you eat multiple times a day, 20 to 25 times a week.”

What’s interesting here is the distinction Xu draws between dining out at a restaurant and ordering delivery. Dining out according to Xu is first and foremost a social experience, while delivery is a utilitarian one. In other words, if what you need is to eat, delivery is not a substitute for going to eat at a restaurant, it’s an entirely different dining experience that doesn’t necessarily involve a social component.

The other reason Xu has to be confident is that DoorDash emerged from the pandemic with a commanding lead in the U.S. market. As of March 2022, DoorDash claimed 57% of U.S. food delivery sales, according to YipitData, compared to Uber’s 31% and Grubhub’s 11%. In the first quarter, DoorDash reported adding more new customers than in any quarter since Q1 2020, hitting a new high in members of its subscription DashPass service, and also reaching a new high in average order frequency, thanks in part to the growth in DashPass members.

So does food delivery compete with dining out? Before the pandemic, a November 2019 report from Morgan Stanley found that most consumers surveyed (46%) said ordering food delivery replaced a meal prepared at home, compared to 13% who said it replaced a meal eaten at a restaurant. Conversely, the main reasons for not ordering delivery among consumers who hadn’t done so were preferring to cook at home (43%), delivery being too expensive (37%), and preferring to dine at a restaurant (37%). The preference for dining out was by far highest among consumers aged 55+ (43%) and lowest among those in the 18-34 bracket (21%).

In other words, even before covid-19, most people already thought of food delivery as a substitute for cooking at home vs. eating out, or avoided delivery because they had a preference for home cooking. But it took covid-19 for food delivery to really take off in the U.S., and so far those gains seem to be sticking. Is it that people are sick of cooking and choosing to order more, or that covid-19 turned us into a nation of hermits who prefer eating takeaway at home to dining out with friends? I would love to see the updated data. Either way, the outcome for DoorDash is a good one.