Hello from a blisteringly hot London, where temperatures have topped 40 degrees Celsius (104 Fahrenheit) in the UK for the first time ever. The UK, a usually temperate climate, is not made for this sort of heat. Roads are buckling, train services are shut, and flights suspended after a section of runway melted at Luton airport. Less than 5%, maybe as little as 1% of homes in the UK have air conditioning, which, while good for the environment, is bad for weathering a heatwave this extreme. This is not fun summer weather; this is a red alert that the climate crisis is here. We are living in the hottest period for 125,000 years; we have just 2.5 years left before emissions must peak to limit global temperature rises to 1.5C; they must virtually halve by 2030 and reach net zero by 2050, targets that look increasingly unlikely in the current political climate. In the meantime, UK summers will keep getting hotter and people will die while the rest of us stock up on rosé and ice cream.

Mile High.

Denver, Colorado, is having a micromobility moment thanks to high gas prices, widespread uptake of bike-share offerings, and a hugely popular e-bike rebate program. Lyft saw a record 308,000 riders use its e-bikes and scooters in the Mile High City in June, while Lime registered 325,000 rides on its scooters and bikes, an 83% increase on the previous year. Lime spokesperson Russell Murphy told the Denver Post that “gas prices have definitely boosted ridership as folks look to more affordable options to get around.” Both Lyft and Lime signed five-year contracts with Denver in 2021.

Meanwhile, an e-bike rebate program Denver launched in April has proven wildly popular. The program offers $400 off regular e-bikes, $1,200 for low-income residents, and an additional $500 off e-cargo bikes. The initiative proved so popular that the city had to pause it after handing out 3,000 rebates in the first three weeks, but it made another 2,000 rebates available on July 11, with half reserved for low-income residents. Demand was so high for that second round of rebates that the city website crashed shortly after going live at 8 a.m. that Monday. “Like trying to buy phish tickets from a crappy municipal website,” one Denverite reportedly complained on Twitter.

Denver has built about 70 miles of bike lanes over the past three years, and plans to add a total of 125 miles by 2024. The city aims to have protected bike lanes available within a quarter mile of every household as part of a plan to reduce car use, increase walking, cycling, and public transit use, and cut carbon emissions. The city plans to offer more rebates each month through the end of the year. Kenny Fischer, owner of FattEBikes, which approached the city with the idea of the rebate program, told local news that he’s noticed more commuters and young families investing in e-bikes. Colorado estimates that a statewide e-bike rebate program launched this year prevented 2,000 pounds of greenhouse gas emissions in June.

Grocery.

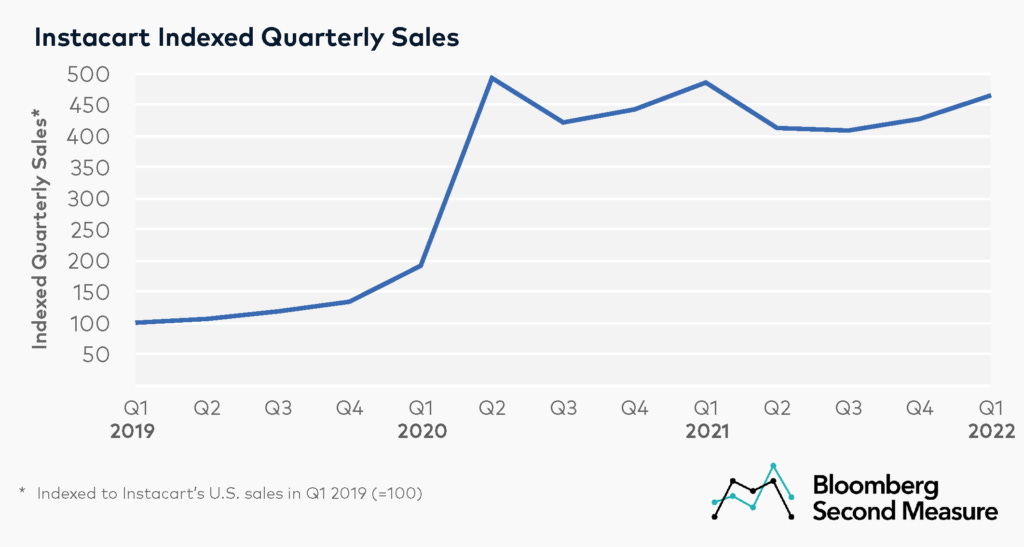

Instacart more than doubled its valuation during the pandemic as analysts heralded a “accelerated secular shift” to online grocery thanks to covid-19. In March 2021, Instacart raised $265 million from existing investors at a $39 billion valuation, up from a $17.7 billion valuation in October 2020. Instacart CFO said in a press release at the time that 2020 “ushered in a new normal, changing the way people shop for groceries and goods.” That certainly looked true in late 2020 and early 2021, before vaccines provided some respite, but so far 2022 has been a slower year.

Instacart’s sales in the first quarter were 4% lower than Q1 2021, according to Bloomberg Second Measure, and the average customer was spending 9% less. In late March, Instacart slashed its valuation by 40% to $24 billion. But several Instacart investors have gone even further. Fidelity has repeatedly marked down Instacart, most recently in May to $48.43 per share, a 25% cut from April and more than half off since January. And at the end of last month, Capital Group Cos. cut its Instacart valuation to $14.7 billion, or $45.84 per share, well below Instacart’s own revised estimate.

Instacart isn’t the only online grocer for whom pandemic boom times seem to be over. UK online grocer Ocado in May halved its growth forecast and reported an 8% drop in sales in the two months to April 25. Ocado blamed its weakened performance on the UK cost of living crisis and a return to “normal consumer behaviours” like going to the office, in-store shopping, and dining out. Ocado’s share price has fallen by more than half since the start of the year. Plus of course there’s the ongoing collapse of ‘instant’ delivery startups. The bigger question is whether people will continue to pay a premium for online grocery as pandemic concerns fade, normal routines resume, and grocery prices soar. A recent U.S. survey by industry analysts Brick Meets Click/Mercatus found U.S. online grocery sales rebounded in June after falling in April and May. All of that will likely affect the fate of Instacart, which said in May that it had filed confidentially to go public but may be facing a rough rest of the year.

Fee caps.

Back in April 2020, San Francisco capped the delivery commissions that companies like DoorDash and Grubhub could charge to restaurants at 15%. In June 2021, the city’s Board of Supervisors unanimously voted to make that cap permanent, prompting DoorDash and Grubhub to sue the city over its “hasty, detrimental, and unconstitutional price controls.” Now the two sides may have reached a compromise. The San Francisco Chronicle reports that DoorDash and Grubhub could drop their lawsuit against the city in exchange for amended legislation that would maintain the 15% cap on fees for restaurants that use the food delivery apps’ most basic services, but allow them to pay more for marketing and better visibility. The Board of Supervisors is due to consider the deal today, which if approved would take effect in January 2023. Food delivery companies also sued New York City last year over a bill making emergency fee caps passed during the pandemic permanent. On the other side of things, commissions charged by food delivery platforms are the subject of an antitrust complaint brought by consumers in New York, who allege that the high fees these companies charge to restaurants have raised prices for all diners.

Other stuff.

New York City is drowning in packages. Human Forest launches e-mopeds in London. May Mobility raises $111 million for driverless ride-hail service. France's Macron defends his dealings with Uber. Uber settles lawsuit with DOJ over alleged disability violations. Uber faces 550-passenger lawsuit over alleged rape and assault in US. Uber loses lawsuit to avoid collective labor agreement in the Netherlands. Uber drivers’ anger over compensation for missed holiday pay. Beirut Uber drivers launch three-day strike over low fares, rising prices. Union calls on UK Uber users to join 24-hour strike over revelations. Uber, Lyft Abortion Travel Pledges Omit Most of Their Workforces. EU antitrust watchdog raids online food and grocery delivery companies on cartel concerns. Cargo bike sales soar as UK petrol prices surge. Vancouver green lights 450 km of new bike lanes and 200 bike lockers. DoorDash to hike subtotal minimums for U.S. subscribers. Amazon Proposes Settlement of EU Antitrust Charges on Seller Data. Amazon Has Been Slashing Private-Label Selection Amid Weak Sales. Amazon’s Ring Gave Surveillance Footage to Authorities 11 Times This Year Without User Consent. NYC housing authority seeks to ban on owning, charging electric bikes inside units. Crypto Crash Stalls WeWork Founder Adam Neumann’s Climate Venture. WeWork co-founder Adam Neumann selling Westchester estate for $4.5M.