Are Americans too lazy for bike-sharing?

CXIII

The big sleep.

Like a Risk player who spreads himself too thin, bike-share company Ofo has commenced a global retreat. The Chinese startup abruptly laid off a majority of its US employees last week and said it was “going into sleep mode” in North America, the same day that it closed up shop in Germany. A week earlier, Ofo announced plans to exit Australia and Israel, scaled back operations in the UK, and laid off staff in India.

Ofo is a Chinese dockless bike-share company, founded in 2014 by students at Beijing’s Peking University. It deploys and manages fleets of bright yellow bicycles that customers can rent through an app for about $1 per 30-minute or one-hour ride, depending on the city. Its name, ofo, is supposed to visually resemble a bicycle.

Ofo raced to an early lead in China’s bike-sharing battle, which has been compared in its intensity to the ride-hailing war that birthed Uber foe Didi Chuxing. Ofo, which claimed in April 2017 to be worth over $2 billion, last raised $866 million in March at an undisclosed valuation. Its backers include Alibaba, Ant Financial, and Didi.

One way to read Ofo’s global pullback is that the dockless bike-share model just didn’t cut it. Ofo claimed to have 15 million bikes circulating in more than 300 cities as of June, with 250 million global users, but it had struggled with theft and vandalism. In the US, Ofo faced skepticism from cities that were used to docked bike-share systems, like Ford GoBike in San Francisco and Citi Bike in New York. Bikes have also recently been upstaged in buzz and popularity by electric scooters. A truly cynical view is that Americans are just too lazy for pedal-powered bike-share to ever take off. (Jump Bikes, an Ofo competitor purchased by Uber in April, markets shared electric bicycles.)

A second way to read the pullback is that it was less about Ofo than the bruising battle between Chinese internet giants Tencent and Alibaba. Tencent, for context, invested in Chinese bike-share company Mobike, while Alibaba backed Ofo. Tencent also holds a roughly 20% stake in Meituan-Dianping, a sort of mega-platform for services in China (think Grubhub + Groupon + Kayak + Uber), which in April bought Mobike for $2.7 billion. Both Alibaba and Tencent, meanwhile, invested in Didi, which has separately backed Ofo, and is reportedly considering its own ride-hailing business.

Here is more from the South China Morning Post:

China’s internet giants are using bike-sharing as an “entry point to their business ecosystem”, said Professor Wu Dong at Zhejiang University School of Management, with the data they gather including user credits and consumption habits. And thanks to numerous investments and acquisitions by Alibaba and Tencent, those ecosystems are growing in complexity.

“As many bike-sharing companies die, they will keep burning money until others quit or they merge as one,” Wu said.

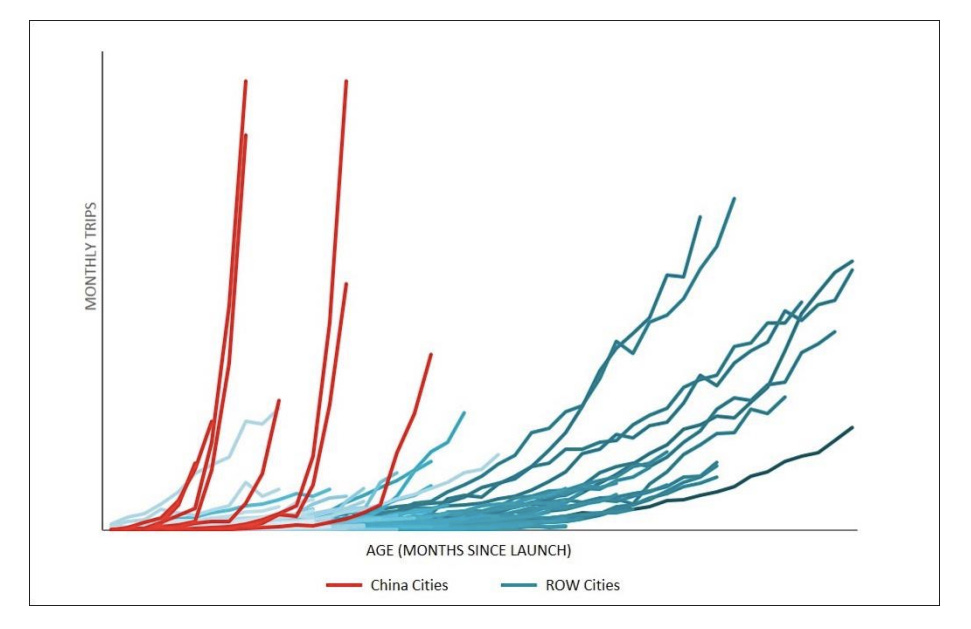

Keep in mind that the market potential in China likely exceeds anything Ofo or Mobike could hope for in the US or overseas. I always think of the chart that Travis Kalanick shared with investors to justify Uber’s China ambitions in June 2015, which is objectively ridiculous, but also an apt visual depiction of this point:

Bellhop politics.

There is an alternate universe in which Airbnb played its hand right in New York early, and now operates a very successful business in a city where its home rentals are always in high demand, but it is not the universe in which we live. In ours, Airbnb is only ever at war with New York City, and at present, the city is winning:

The City Council on Wednesday passed a controversial bill to crack down on Airbnb’s home rental business in the city.

The legislation, which the mayor is expected to sign, will require the company to hand over all of its hosts’ names and addresses to an enforcement office—a move likely to expose some hosts to fines for renting out apartments for less than 30 days, which is illegal under state law, and drive some who don’t want their information shared off the platform altogether.

It passed by a vote of 45-0.

Airbnb and other home-rental companies will be expected to provide this information to the city every month, or face fines of up to $1,500 for each undisclosed listing. Two years earlier, New York state passed some of the toughest restrictions on home-rentals in the US, making it illegal to rent or advertise the rental of an entire apartment for less than 30 days, unless the host was present and there were no more than two guests.

Securing addresses and listing information will things easier for the city’s Office of Special Enforcement (OSE), the agency tasked with enforcing home-rental rules. Without cooperation from Airbnb, OSE has previously turned to shadier tactics, such as dispatching sheriffs (yes, sheriffs) to the homes of suspected Airbnb hosts and threatening them with civil summonses for building code violations, like “lack of a system of automatic sprinklers… in transient occupied buildings.” OSE’s staff and budget have roughly quadrupled, to 48 people and $6.45 million, since June 2015. The city has already sued Airbnb to force compliance with the new legislation.

A week after Skip Karol appeared at the Council hearing to criticize the de Blasio administration and the proposed anti-Airbnb legislation, OSE enforcement officers descended on his Sunset Park home and issued four (baseless) summonses which in total demand payment of up to $32,000 in fines. Skip Karol doesn’t have the money to fight these tickets – much less the money to pay the exorbitant fines if the summonses are ultimately sustained.

Karol, 58, lives in Sunset Park in Brooklyn in a two-family home his parents purchased in 1963. He’s been unemployed since 2010 and is disabled, so rents out the second floor and basement of this home, currently through Airbnb, for additional income. You get the picture. Karol had run into trouble with the city last year for being on Airbnb—he was ticketed for not having a sprinkler system or fire exit—but had the charges dismissed at a hearing in July 2017. He now faces four new summonses for what seem like identical violations, with a September hearing and a potential bill of $32,000.

It is not a great look for either side. New York used to say its problem with home-rentals was the so-called “bad operators”—landlords with lots of listings who were turning buildings intended for permanent residents into pseudo-hotels—and that it didn’t intend to go after the little guy. Karol and some of the other Airbnb hosts being prosecuted now for their rental activities are nothing if not the little guy. But Airbnb also isn’t so innocent. It spent years breaking the law and refusing to cooperate with local regulators in New York City, while picking fights with the hotel lobby and accusing local politicians of hurting the middle class (Karol’s lawsuit contains a lengthy digression on corruption in city politics and the hotel industry).

One thing you can say for Uber is that it never pretended to be the good guy when it was acting like a jerk. Airbnb, blinded by its own self-righteousness, may never learn.

Too much supervision.

Three former Uber drivers have been declared employees for the purpose of collecting unemployment benefits, in a final decision issued earlier this month by the New York State Unemployment Insurance Appeal Board. After multiple appeals by Uber, that makes this final verdict the official position of New York state.

The appeal board found that Uber “exercises supervision, direction or control over the three claimants and other similarly situated Drivers.” Specifically, the board cited:

Uber’s driver app. “Uber provides the Driver App and sets up the information that appears on the Driver App sets the fares charged to Riders; sets the rate of pay to Drivers and the occasional income guarantee; sets the various incentives and promotions; and sets the music tipping and deactivation policies.”

Uber’s driver hubs, driver handbook, and referrals to specific car dealerships

How Uber monitors driver performance. “Uber fielded complaints and regularly communicated feedback to the Drivers, including the minimum threshold star rating to avoid suspension, and communicated the trip’s most efficient route and the Drivers’ acceleration, braking, and overall speed.”

And the clincher: “Although Uber contends that it is merely a technology platform that connects Riders to Drivers, its business is similar in many respects to other more traditional car service companies.”

This is obviously bad news for Uber, which has spent years fighting the idea that its drivers are employees rather than independent contractors, as well as other gig economy companies with similar business models. Employees would be much more expensive for Uber (for starters, they would be guaranteed a minimum wage and entitled to benefits) and could render its entire business unsustainable.

Veena Dubal, a labor law professor at University of California Hastings College of the Law, told Ars Technica the decision “means that New York Uber drivers can file for unemployment insurance and likely receive it.” Should Uber appeal the state’s decision, it would go directly to the appellate division of New York Supreme Court.

Scooters!

Lime released a report (pdf) on its first year of business. The electric- scooter and bike company says it topped 6 million rides over the last 12 months, with half of those happening since May. Here is a colorful and vaguely labeled line chart showing that:

Electric-assist bikes get riders to their destination 21% faster than traditional pedal bikes

Electric scooters get riders to destinations 22% faster than pedal bikes (I somehow doubt this one percentage point difference was statistically significant)

27% of riders in “major urban markets” used Lime to connect to public transit

51% of these riders reported household income of less than $75,000

Lime, and scooter/bike-share companies more broadly, have positioned themselves as crucial additions to urban transit, the best answer to how to get from your home to the subway, or from a parking garage to your office. These companies have also claimed to help lower-income communities, which have historically been underserved by trains, taxis, and even traditional docked bike-share programs, which are expensive to install and tend to come first to wealthier neighborhoods. You can never put too much stock in company-produced reports, but Lime’s suggests it is on the right path.

Other stuff.

Autonomous cars speed into policy debates. Zoox tests driverless cars in downtown San Francisco. Waymo logs 1 million autonomous miles in one month. Gett considers selling Juno, exiting US market. Self-Driving Cars Are on the Road to Nowhere. DoorDash hires Uber’s Prabir Adarkar as chief financial officer. Uber hires chief privacy officer from Intel. Susan Fowler joins the New York Times. Uber launches $1 million campaign for congestion pricing. Uber e-bikes are decreasing Uber car rides in San Francisco. Avis CEO Says Rental Car Biz Is Alive and Well. Uber driver caught streaming rides on Twitch. Middle East climbs in most expensive Airbnb cities. WeWork could go after Regus clients. US hyperloop startups get financing from China. Peter Thiel weighs investments in Chinese startups. Postmates offers free Burger King chicken fries. Uber vomit fraud. The blockchain of property.