Hello and welcome to Oversharing, a newsletter about the proverbial sharing economy. If you're returning from last week, thanks! If you're new, nice to have you! (Over)share the love and tell your friends to sign up here.

Congratulations to Quartz, which knocked out APATITE with 61% of the vote in the second round of the 2018 Mineral Cup. Hope it’s not too blue (get it, get it). I started out covering this in jest but if I’m being honest am now very invested in seeing Quartz go all the way.

The gig is up.

The gig economy is really just the Uber economy.

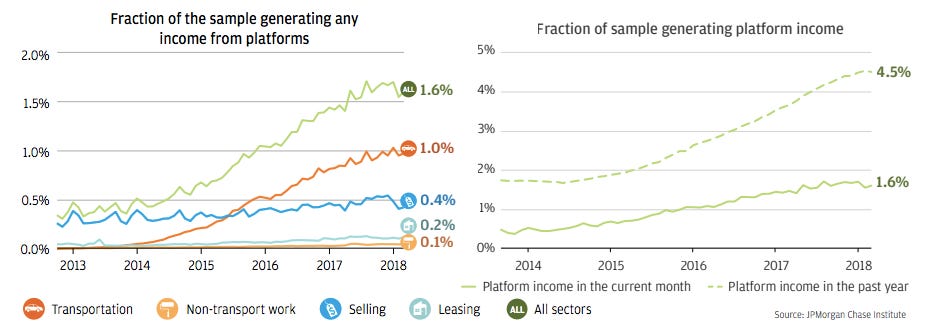

The latest data point on that comes from the JPMorgan Chase Institute, a think tank run by the investment bank. According to a study published Sept. 24 (pdf), as many people in the US work for and earn money from online “transportation” platforms (e.g., Uber) as all other categories of online platform work combined.

“Other” in this case is “non-transport work” (e.g., TaskRabbit), “selling” (e.g., Amazon, eBay), and “leasing” (e.g., Airbnb, Turo). In any given month, 1% of families were earning money through app-based transportation companies, compared to less than half a percent in the other categories, according to an analysis of 38 million payments and 2.3 million Chase checking accounts from October 2012 to March 2018.

The JPMorgan Chase Institute has done some of the best research on the gig economy. The institute’s first report (pdf) on gig work in February 2016 found that, despite the hype around Uber and gigs as the future of work, only 0.4% of US adults were working an app-based job in any given month. The report described a modern, digital struggle between capital and labor. People who rented out assets (homes, cars) on platforms like Airbnb added to their monthly income, while people who labored for companies like Uber did so to keep their earnings steady from month to month. A second report in November 2016 suggested Americans had tired of gig work.

While more people are working in the gig economy, and on Uber-like apps, now than in 2016, they may not be doing so with the same intensity. Per the institute’s latest report, average monthly earnings on transportation platforms fell 53%, or to $783 from $1,469, from the fourth quarter of 2013 to the first quarter of 2018.

JPMorgan doesn’t know why this is. They see monthly earnings but not hours worked or hourly wages. The decline “may reflect the fact that the growth in the number of drivers could have put downward pressure on hourly wages; they may also reflect a potential decline in the number of hours drivers are driving,” the report says.

One interesting question would be whether people are relying less on companies like Uber as the economy has strengthened. Uber, Airbnb, TaskRabbit, and many others got started either during the financial crisis or in its immediate aftermath. Millions of people had lost their jobs and savings, and so being able to sign onto an app to drive a car, or deliver food, or rent a property, or do odd jobs, and get paid that week or day, was an attractive proposition. It’s no coincidence that Uber’s fastest growth is now happening in Argentina, where an economic crisis “has certainly helped many people find us as an alternative source of income,” Felipe Fernandez Aramburu, Uber’s local head of business development, told Reuters.

In the US, workers have gotten their footing again. Unemployment is at 3.9% and wages are finally rising (though so is inflation). That means all workers, including those in the gig economy, have more options. Looking beyond Uber is one of them.

Sharing Economy Award Exemption.

Every sharing economy startup is composed of two distinct workforces: the people who are employed by it in some sort of corporate capacity, and the people who provide the assets or labor to make the platform run. There are Uber employees and Uber drivers, Airbnb employees and Airbnb hosts, Postmates employees and Postmates couriers—you get the idea. The former get salaries and benefits and work in offices with exposed brick, raw-wood tables, and fridges stocked with LaCroix; the latter are independent contractors who drive their cars or rent their homes or run around delivering stuff for piecemeal wages.

Another thing that separates these two types of workers is stock. Most people who work at a startup as employees get stock options as part of their compensation package. The idea is that stock helps with retention (you usually get it over four or so years, rather than all at once) and quite literally makes employees more invested in the success of the company, since the better the business does, the more their stock is worth. This benefit typically hasn’t been extended to the other type of worker—the Uber driver, Airbnb host, delivery courier—because of current securities law.

Airbnb is interested in changing that. “Airbnb believes that twenty-first century companies are most successful when the interests of all stakeholders are aligned,” general counsel Rob Chesnut wrote in a letter to the Securities and Exchange Commission on Sept. 21. “For sharing economy companies like Airbnb, this includes our employees and investors, but also the hosts who use our marketplace to list unique accommodations and experiences.”

The last sharing economy company to insert itself into the equity-for-contractors debate was Juno, an Uber competitor in New York City. Juno arrived in New York in early 2016 and lured drivers from Uber and Lyft by promising lower commissions, no shared rides, and a unique equity program that would let drivers earn shares in the company. Drivers who had soured on Uber and Lyft took Juno at its word, especially on the equity program. On many of my Juno rides, drivers would tell me about the special stock program, and how it meant they’d continue to profit even after being replaced by self-driving cars. Juno founder Talmon Marco encouraged this perception.

In April 2017, Juno sold to competitor Gett. As part of the sale, Juno told drivers its stock program had been terminated, “effective immediately.” It was a convenient exit for Juno, whose restricted-stock-unit program, it turned out, had never been properly hashed out with the SEC. “The SEC had asked Juno to change how it was implementing the program going forward, specifically registering it or using an exemption from registration in a different manner,” Juno wrote in a “legal blurb” appended to its email to drivers announcing the sale. “Given these discussions with the SEC, Juno was considering, among other things, whether the RSUs previously granted were void under the terms of the RSU program.”

Airbnb proposes a “Sharing Economy Award Exemption” that would allow sharing economy companies to grant equity to their non-employee participants. It assures the SEC that the goal of this is not to help it or other companies raise capital and further delay an IPO, but to better align the goals of the companies and their workforces. “Such issuances would not provide liquidity to issuers and they would still need to seek access to the public capital markets to fund acquisitions or significant capital expenditures,” Chesnut writes, and honestly it’s kind of funny to think of equity grants to Airbnb hosts as a threat to companies going public when SoftBank is handing out billion-dollar checks like candy on Halloween.

Scooters!

A Chinese maker of electric scooters wants to go public in the US:

Beijing-based Niu Technologies, an electric scooter start-up, has filed for a US initial public offering to raise US$150 million, under the symbol NIU.

Financial terms of the offering have not been disclosed. Credit Suisse and Citi are the joint bookrunners on the deal.

The F-1 is here. Some facts from the filing:

The market for electric two-wheeled vehicles in China is expected to reach 34.9 million units and $13 billion (USD) by 2022

In the EU, that same market is projected to be 3.7 million units and €7.5 billion by 2022

Niu lost $47.6 million on $84.2 million in revenue in the six months ended June 30, 2018

What a time to be alive, when scooter companies are planning public offerings.

Elsewhere in scooters, California’s governor signed a law that requires helmets only for riders under the age of 18. A New York City councilman is pushing for the city to legalize scooters ahead of the L-train shutdown (the city says it’s up to the state). Bird’s CEO calls scooters “Ride-sharing 2.0.” And yes, you can get a DUI for drunk scooting:

a 25-year-old man was stopped at a DUI checkpoint in Santa Monica, California last weekend when he attempted to scoot by the Los Angeles police on the sidewalk allegedly inebriated.

When police noticed the unmistakable stench of alcohol and attempted to breathalyze the man, he refused. After allegedly failing a field sobriety test, he was arrested and charged with a misdemeanor DUI.

Drinking-and-scooting is presumably preferable to drink-and-driving as a drunk person on a scooter can do a lot less damage, but both are bad. Scooters, after all, go 15mph to 20mph and that is a good amount of speed to gather when your reflexes aren’t fully about you. Per Bird’s user agreement, “You must not operate a Vehicle while under the influence of any alcohol, drugs, medication, or other substance that may impair Your ability to operate a Vehicle safely.” When they break out the Random Capitalization, You know They are Serious.

Fine to merge.

Singapore fined Uber and Grab more than S$13 million ($9.5 million) over a March deal for Uber to sell Grab its southeast Asian operations, in exchange for a 27.5% stake in the combined business. Singapore’s Competition and Consumer Commission called the deal “anti-competitive” and said the fine was issued to “deter completed, irreversible mergers that harm competition.” It’s letting the deal proceed all the same.

In addition to the fine, the commission put some restrictions on the deal:

The anti-trust watchdog said it would require that Grab drivers not be tied to Grab exclusively and that Grab’s exclusivity arrangements with any taxi fleets be removed.

Uber will also be required to sell its car rental business to any rival that makes a reasonable offer and will not be allowed to sell those vehicles to Grab without the watchdog’s permission. The car rental business, Lion City, had a fleet of some 14,000 vehicles as of December.

Perhaps most interesting is the market restrictions the regulator imposed. Grab has been instructed to “maintain its pre-merger pricing algorithm and driver commission rates,” so that riders aren’t charged excessive surge, and drivers forced to pay Grab excessive commission. The regulator said it would temporarily suspend these measures if a Grab rival gained at least 30% of rides in the market in a month, and remove them if a rival gained at least 30% of rides for six consecutive months.

Both Uber and Grab said they were disappointed by the decision, which I suppose is a thing you say when a regulatory agency chides you for anticompetitive practices, restricts your business practices, and asks you to fork over several million dollars. Also can you even imagine the fit Uber would throw if the US froze its pricing algorithms and driver commission rates? The company would go on strike! There would be no rides, the app would be overrun with pop-ups, Dara would look like the world’s most disappointed dad, drivers would riot, riders would riot, traffic would grind to a halt, the subway would stop running entirely, roads would collapse, buildings tremble, storms brew, and chaos overshadow the land. I mean I don’t know, I can’t see the future, but that is how I imagine Uber would tell us it would go.

This time last year.

Uber loses license in London, Albertsons acquires Plated, Walmart wants a key to your fridge

Other stuff.

Australia embraces Airbnb. Grubhub buys Tapingo for $150 million. Uber in talks to buy Deliveroo. Amazon previously in talks with Deliveroo. Careem buys mass-transit app Commut. Airbnb loses engineering VP Mike Curtis. Lyft adds public transit details to Lyft app. Lyft drivers seek settlement on premium pay. Portuguese protest short-term tourist rentals. Airbnb expands Open Homes program to include medical stays. Instacart needs to treat shoppers better. Instacart expands tech hub in Toronto. Airport parking struggles to compete with Uber, Lyft. UN study finds American crowdworkers earn below $5 an hour. Mike Bloomberg was a sharing economy candidate. Companies work to get the vote out. Uber wedding. To save a tiny village, turn it into a resort. How Puerto Rico Became a Tax Haven for the Super Rich.

Thanks again for subscribing to Oversharing! If you, in the spirit of the sharing economy, would like to share this newsletter with a friend, you can forward it or suggest they sign up here.

Send tips, comments, and scooter DUI reports to @alisongriswold on Twitter, or oversharingstuff@gmail.com.