Unwelcome guests.

Airbnb likes to position itself as a friend of cities, but it’s having a lot of trouble in the US. Here is a short list of places where Airbnb is, er, finding it hard to belong:

New York: Where, in late June, the state senate passed a bill making it illegal to advertise entire apartments for less than 30 days on Airbnb’s platform. Airbnb calls this “a bad proposal that will make it harder for thousands of New Yorkers to pay the bills.” (Note: It is already illegal under New York state law to rent entire apartments for less than 30 days on any platform.)

Chicago: Where, also in late June, the city council passed rules to limit which apartments can be rented out on Airbnb and to levy new fees on the company. (For example: a 4% tax on each rental to fund services for the homeless, and a $60 charge for each Chicago address listed to help the city fund enforcement of its new rules). Airbnb has “no current plans to litigate” against the city’s ordinance.

San Francisco: Where, by contrast, the company has every intention of litigating, and last week sued the city over its plan to fine Airbnb $1,000 a day for every unregistered host on the platform. This confrontation is particularly hostile, as regulators feel Airbnb is attempting to dodge a law that it once worked with them to pass. “Airbnb is proving that it wants to play by its own rules, that it believes that it is entitled to something no business has, absolute freedom to operate free of responsibility and oversight,” says David Campos, a member of SF’s board of supervisors.

Such is often the reality for Airbnb, which despite its good-neighbor rhetoric (see: the Airbnb Community Compact) can quickly change tones when its own best interests are at risk. And they often are in big cities with high rents and constrained housing. The fear among local officials is that landlords will decide it’s more lucrative to rent their units on Airbnb in perpetuity than to lease them to long-term residents. Airbnb likes to say this is a myth put out by the hotel lobby and affordable housing advocates, but from personal experience I can tell you it’s a thing that happens. Cities are right to be worried; Airbnb of course wants to protect its business. The two are bound to clash.

Settling up.

Twoish years ago, Lyft filed suit against Travis VanderZanden, its former chief operating officer who left to become VP of international growth at Uber, for stealing confidential internal documents. The suit alleged, among other things, that VanderZanden had taken numerous steps “to transfer Lyft information to his personal files in anticipation of his resignation” including “systematically upload[ing] confidential and proprietary Lyft documents” to his personal Dropbox account and using his Lyft computer to search “how to archive in google apps” and “how to backup google apps email.” Also, writing “Backup Lyft Email and Contacts” on an Evernote to-do list. (Note to future tech employees looking to copy and back up confidential corporate information: perhaps don’t Google how to do those things from your work computer, or record your intentions in Evernote.)

Then, because these things really only get better, VanderZanden in March claimed that Lyft had invaded his privacy by looking into his personal Dropbox account. All of this was scheduled to head to trial in August until last week, when Uber and Lyft abruptly settled, reportedly for no money. Perhaps not coincidentally, the settlement also came alongside the news that Lyft had hired Qatalyst partners, a boutique investment bank best known for helping tech companies get acquired. As Reuters says, “It is common for companies to eliminate uncertainties such as legal risk ahead of a deal.”

Lyft leaks.

In other Lyft news, a company investor letter leaked last week with some numbers on Lyft growth. Among them:

May rides increased by nearly 1.3 million month-over-month to 12.7 million

“100% paid riders” (those who don’t use any coupon or other Lyft credit) increased 5% from April to May

Lyft had 2.8 million unique riders in May, up 320,000 from April

I’m most interested in bullets one and two, which, while not apples to apples (the first is rides, the second riders), still seem not-the-best. The first indicates 11.4% growth month-over-month in all rides; the second just 5% growth in riders who are actually paying their entire fares. In other words, a LOT of Lyft’s growth is coming from subsidies. We basically already knew this. Eric Newcomer at Bloomberg reported in April that Lyft is losing as much as $50 million a month to steal market share from Uber, and here in New York I have a front-row seat to the promotions that Lyft has been pushing out every single week. (It’s finally traded “limited time” and “last chance!” emails for “deal of the week” ones.) Ride-hailing might be asset-light, but it’s certainly not cheap. The question is whether Lyft can make its business sustainable when so much depends on subsidies.

Quarter closed.

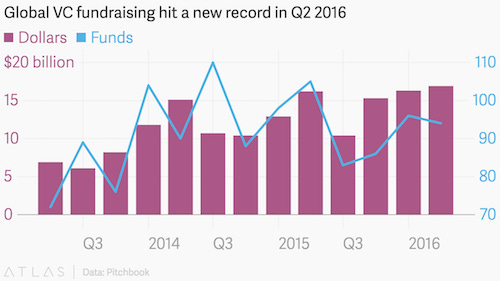

Venture capitalists raised a record-setting $16.9 billion in the second quarter across 94 funds, according to data from Pitchbook, the latest sign that money continues to flow freely to investors even as their disbursements to startups have waned. The deals included a $1.5 billion fund closed in June by Andreessen Horowitz (to invest “under the broad thesis of ‘software is eating the world’”) and a pair of funds from Kleiner Perkins Caufield & Byers that totaled $1.4 billion.

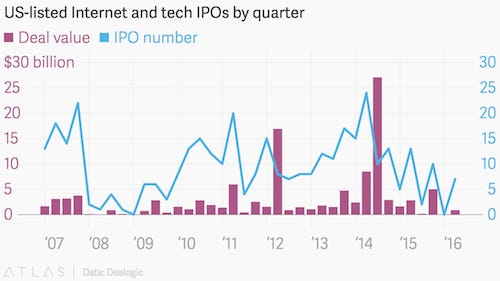

Meanwhile, the market for tech IPOs warmed in the second quarter, with seven tech/internet companies going public on US exchanges per Dealogic. That was a significant improvement from the zero that debuted in the first quarter—the worst for tech IPOs since the Great Recession—but lackluster compared to the second quarter of 2015, when 13 tech companies listed on US exchanges in deals worth $2.8 billion.

Other stuff.

Are You My Uber? Glover Park Group is lobbying for Lyft. Who Will Acquire Lyft? Controversial Uber legislation creates windfall for lobbyists in Massachusetts. Uber, Lyft resume business in Tuscaloosa. Handy acquires Move Loot’s customers. Instacart thinks it’s found a way to make money. Scandal-ridden Zenefits cuts its valuation in half. Another round of layoffs at Birchbox. Snapchat Went Down and Kids Were Freaking Out. Smugglers Use Uber-Registered Drivers to Move Migrants to US Border. Uber data tapped for car loans in Kenya. Grab is beating Uber in Southeast Asia? Uber hot air balloons. IPOs as branding events. Emoji cryptography. “Morality, such as it exists in the tech whorehouse, is an expensive hobby indeed.”